How I Built a Steady Future for My Family’s Wealth—No Luck Needed

What if your family’s wealth didn’t depend on market highs or risky bets? I used to worry about passing down assets that could vanish overnight. Then I shifted focus—from chasing returns to building stability. It wasn’t flashy, but it worked. In this article, I’ll walk you through the practical strategies I tested and trusted to protect and grow wealth across generations. Stability isn’t boring; it’s the foundation of lasting financial freedom. Over years of careful planning, I learned that true financial security doesn’t come from sudden windfalls or aggressive investments. It comes from consistency, structure, and the discipline to stay the course. This is not a story of overnight success. It’s a roadmap built on real choices, real trade-offs, and the quiet power of long-term thinking.

The Real Challenge Behind Family Wealth Transfer

Most people believe the hardest part of wealth is making it. But for families aiming to preserve what they’ve built, the real challenge lies in keeping it. Studies consistently show that roughly 70% of wealthy families lose their fortune by the second generation, and about 90% by the third. This pattern isn’t due to bad luck or economic collapse alone—it stems from unstructured planning, emotional decision-making, and a lack of shared financial values. Without a deliberate framework, wealth becomes vulnerable to fragmentation, poor investment choices, and family conflict. The transition from first-generation wealth creator to second-generation steward is often where momentum stalls.

One major reason for this decline is the absence of clear communication. Parents may hesitate to discuss money with their children, fearing it will breed entitlement or reduce motivation. Yet silence creates uncertainty, and uncertainty breeds anxiety and misalignment. When heirs don’t understand the origins of the family’s wealth or the principles behind its management, they’re more likely to make impulsive decisions. They may overspend, invest recklessly, or fail to appreciate the effort required to sustain prosperity. The absence of financial education leaves them unprepared to manage assets responsibly, even when legal ownership transfers smoothly.

Another critical gap is the lack of formal structure. Many families rely solely on wills, which address only the final distribution of assets. Wills do not offer ongoing protection from taxes, creditors, or mismanagement. They also don’t provide mechanisms for governance or conflict resolution. As a result, siblings may disagree on how to manage inherited investments, or a surviving spouse may face unexpected tax burdens. Without tools like trusts or family governance agreements, wealth can erode quickly, not because of market forces, but because of internal disorganization. The real risk isn’t losing money in a downturn—it’s losing control due to poor planning.

The lesson is clear: preserving wealth across generations requires more than financial capital. It demands intellectual capital—knowledge passed down—and emotional capital—shared values and trust. Families that succeed over the long term treat wealth management as a continuous process, not a one-time event. They establish systems that outlive individuals, ensuring decisions are guided by principles rather than emotions. This shift—from reactive inheritance to proactive stewardship—is what separates enduring family wealth from temporary affluence.

Stability Over Speed: Why Predictable Returns Beat High-Risk Plays

In the world of investing, speed often captures attention. Stories of rapid gains from tech startups, cryptocurrency surges, or speculative real estate deals dominate headlines. But for families focused on long-term sustainability, chasing high returns is often a path to erosion, not enrichment. Volatile investments may deliver short-term excitement, but they also carry the risk of sudden, irreversible losses. Instead, the most reliable path to growing wealth over decades is through consistent, predictable returns. This approach prioritizes capital preservation and steady compounding over the allure of quick wins.

Consider two investment strategies over a 30-year period. The first achieves an average annual return of 12% but experiences extreme swings—gains of 30% in some years, losses of 20% in others. The second delivers a more modest 7% annual return with minimal volatility. At first glance, the higher average seems superior. But due to the impact of compound losses, the lower-volatility portfolio often ends up ahead. A 20% loss requires a 25% gain just to break even. Frequent drawdowns disrupt compounding and force investors to take on more risk to recover. Over time, the emotional toll of volatility leads to poor timing—selling low, buying high—which further reduces real-world returns.

Assets that generate stable, income-based returns are the cornerstone of this philosophy. Dividend-paying stocks from established companies provide regular cash flow and have historically outperformed non-dividend payers over long periods. These companies tend to be financially disciplined, with strong cash flows and mature business models. High-quality bonds, particularly government and investment-grade corporate bonds, offer predictable interest payments and serve as a buffer during market downturns. Real estate investments that produce rental income—such as residential properties in stable markets or commercial leases with creditworthy tenants—add another layer of diversification and yield.

The key is alignment with long-term goals. A family aiming to fund education, support retirement, or maintain a lifestyle across generations doesn’t need to beat the market every year. It needs to avoid catastrophic losses and maintain purchasing power. By focusing on assets with reliable income and low turnover, families can reduce exposure to speculation while still achieving meaningful growth. This doesn’t mean avoiding equities altogether—equities remain essential for inflation protection—but it does mean choosing them wisely. The goal is not to time the market, but to stay in it, with a portfolio structured to endure cycles, not exploit them.

Structuring Assets Like a Safety Net: Tools That Last Generations

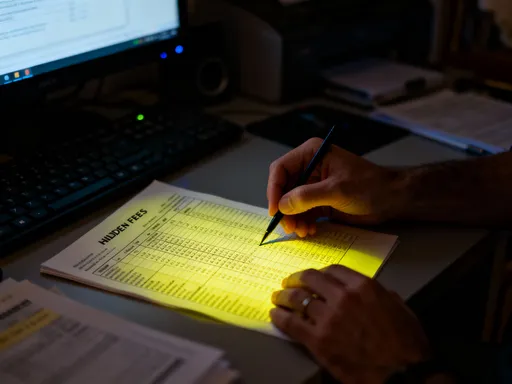

Wealth preservation begins with structure. No matter how well-invested a portfolio may be, without legal and financial frameworks in place, it remains exposed to taxes, legal claims, and internal mismanagement. The most effective families use time-tested tools to create a protective layer around their assets. These mechanisms do not eliminate risk, but they significantly reduce its impact. Among the most powerful are trusts, family limited partnerships, and insurance strategies—each serving distinct but complementary roles in long-term planning.

Trusts are perhaps the most versatile of these tools. A properly designed trust allows assets to be managed according to specific instructions, even after the original owner is no longer able to make decisions or has passed away. Revocable living trusts provide flexibility during the grantor’s lifetime and help avoid probate, the often lengthy and public legal process of settling an estate. Irrevocable trusts go a step further by removing assets from the estate entirely, potentially reducing estate tax liability and shielding them from creditors. For families with significant wealth, irrevocable life insurance trusts (ILITs) can be used to pay estate taxes without liquidating other assets, preserving the integrity of the estate.

Family limited partnerships (FLPs) offer another layer of control and protection. In an FLP, family members become limited partners who hold ownership interests, while one or more general partners manage the assets. This structure allows for centralized decision-making while gradually transferring ownership to younger generations. It also provides valuation discounts for gift and estate tax purposes, as limited partnership interests are typically valued at a discount due to lack of control and marketability. More importantly, FLPs establish a formal framework for how family assets are governed, encouraging collaboration and reducing the risk of disputes.

Insurance is often overlooked as a wealth preservation tool, but it plays a critical role. Life insurance ensures liquidity at the time of death, preventing the need to sell investments at an inopportune time to cover expenses. Long-term care insurance protects retirement assets from the high costs of assisted living or nursing care. Umbrella liability policies provide an extra layer of protection against lawsuits that could otherwise threaten personal wealth. When used strategically, insurance acts as a financial shock absorber, allowing families to maintain stability in the face of unexpected events. Together, these tools form a safety net—strong, flexible, and designed to endure.

The Discipline of Regular Portfolio Rebalancing

Markets change, and so do life circumstances. A portfolio that was perfectly balanced five years ago may now be heavily tilted toward one asset class simply because of strong performance. For example, if stocks have risen sharply, they may now represent a much larger share of the portfolio than originally intended. While this may seem like a success, it also increases risk. Without intervention, the portfolio drifts away from its target allocation, exposing the family to greater volatility than planned. This is where the practice of regular rebalancing becomes essential.

Rebalancing is the process of realigning the portfolio to its original asset allocation. If stocks have grown from 60% to 75% of the portfolio, rebalancing involves selling some stocks and reinvesting in bonds or other underweighted assets to restore the 60/40 balance. This may feel counterintuitive—selling assets that have performed well—but it enforces discipline and manages risk. It ensures that the portfolio does not become overly dependent on any single market outcome. Over time, rebalancing also introduces a subtle form of “buy low, sell high,” as it systematically reduces exposure to overvalued assets and increases exposure to undervalued ones.

The frequency of rebalancing matters, but perfection is not required. Many families choose an annual review, often tied to the start of the new year or the anniversary of the portfolio’s creation. Others use threshold-based rebalancing, triggering a review only when an asset class deviates by more than 5% from its target. Both approaches work, as long as they are followed consistently. The key is to remove emotion from the process. Rebalancing should not be driven by market predictions or news headlines, but by a pre-established plan. This turns a potentially stressful decision into a routine maintenance task.

Rebalancing also adapts to life stages. A young family with a long time horizon may tolerate more stock exposure and rebalance less frequently. As they approach retirement, the focus shifts to capital preservation, and rebalancing helps lock in gains and reduce risk. Later, in the wealth transfer phase, the portfolio may emphasize income and stability, with rebalancing ensuring that withdrawals do not deplete principal too quickly. By making rebalancing a habit, families build resilience. They avoid the pitfalls of complacency and overreaction, staying aligned with their long-term objectives regardless of market noise.

Teaching the Next Generation Without Handing Over Control

Passing down wealth without passing down wisdom is a recipe for loss. Many families make the mistake of waiting until a child reaches a certain age or inherits assets before introducing them to financial concepts. By then, the learning curve is steep, and the stakes are high. A better approach is to begin financial education early, using age-appropriate lessons and gradual exposure. The goal is not to hand over control prematurely, but to build competence and confidence over time.

Financial literacy can start in childhood with simple lessons about saving, budgeting, and delayed gratification. A child who learns to save allowance for a desired toy begins to understand the value of money. As they grow, discussions can expand to include investing basics, such as compound interest and risk. Teenagers might be given a small amount to manage in a custodial account, with guidance on choosing low-cost index funds or dividend stocks. This hands-on experience fosters responsibility without exposing the family’s entire portfolio to experimentation.

In young adulthood, the education becomes more structured. Some families hold regular family meetings to discuss financial goals, investment performance, and charitable giving. These meetings normalize conversations about money and create a culture of transparency. Heirs may be invited to shadow investment decisions, observing how research is conducted and how risks are evaluated. In some cases, a portion of the family’s portfolio is allocated to a “learning fund,” where the next generation can propose investments under supervision. This allows them to experience both success and failure in a controlled environment.

Mentorship also plays a crucial role. Engaging a financial advisor or family office professional to serve as a teacher and coach helps ensure that knowledge is transferred objectively. It also reduces the burden on parents, who may struggle to separate emotional guidance from financial instruction. Over time, heirs develop not just technical skills, but a mindset of stewardship—understanding that wealth is not for personal indulgence, but for long-term family benefit. When control is eventually transferred, it is not a sudden handoff, but the natural outcome of years of preparation.

Avoiding the Emotional Traps That Break Wealth Chains

Even the best financial plans can fail when emotions take over. Family dynamics—sibling rivalries, parental favoritism, unspoken expectations—can turn wealth into a source of conflict rather than security. One of the most common pitfalls is unequal treatment, whether real or perceived. A parent who gives one child financial help for a home while another receives nothing may unintentionally plant seeds of resentment. Similarly, sudden access to large sums of money can lead to overspending, especially if the recipient lacks financial maturity.

To counter these risks, families benefit from neutral systems that promote fairness and accountability. One effective tool is a family constitution—a written document that outlines shared values, financial principles, and decision-making processes. It may specify how assets will be managed, how disputes will be resolved, and what is expected of heirs. While not legally binding, a family constitution serves as a reference point during difficult conversations. It shifts the discussion from personal grievances to agreed-upon principles.

Independent advisory boards are another safeguard. These groups, composed of trusted professionals such as financial advisors, attorneys, or accountants, provide objective input on major decisions. They can mediate disagreements, review investment strategies, and ensure that governance rules are followed. Their presence reduces the likelihood of one family member dominating decisions or acting in self-interest. For larger families, a formal family council—elected representatives from each branch—can serve a similar function, giving all members a voice in stewardship.

Clear communication is essential. Regular family meetings, facilitated by a neutral party if necessary, create space for open dialogue. These meetings should not focus only on finances, but also on relationships, values, and long-term vision. When family members feel heard and included, they are more likely to support collective decisions. Transparency reduces suspicion, and shared purpose reduces conflict. By addressing emotional dynamics proactively, families can protect their wealth from internal erosion—the kind that no investment strategy can prevent.

Building a Legacy That Grows Quietly, But Surely

True legacy wealth is not measured by luxury homes or exotic vacations. It is measured by stability, opportunity, and the ability to support future generations without strain. The families that succeed over decades are not those who made the most money, but those who protected it wisely. Their success is not the result of luck or genius, but of deliberate choices—choosing consistency over spectacle, structure over spontaneity, and education over entitlement.

This philosophy is not about avoiding growth. It is about pursuing growth in a way that does not compromise security. It embraces the power of compound returns, not through speculation, but through patience. It uses legal and financial tools not to hide wealth, but to preserve it. It teaches the next generation not to spend, but to steward. Every decision is made with the long view in mind—what will this look like in 20, 50, or 100 years?

The most powerful aspect of this approach is its quiet sustainability. There are no headlines, no viral success stories. Instead, there is a steady accumulation of value, a deepening of family cohesion, and a growing sense of purpose. Children grow up knowing they are part of something larger than themselves. They inherit not just money, but a system, a set of values, and a responsibility to continue the work.

Building such a legacy does not require perfection. It requires intention. It starts with a single conversation, a first meeting, or a decision to create a trust. It grows through consistent habits—annual reviews, family discussions, gradual education. Over time, these small actions compound, just like financial returns. The foundation is laid not in a day, but over years. And when future generations look back, they do not see a windfall. They see a path—one that was carefully built, thoughtfully maintained, and generously shared. That is the quiet power of lasting wealth.