Passing Down More Than Money: A System for Wealth and Legacy

We all want to leave something behind—not just cash, but values, wisdom, and stability for the next generation. Yet, managing wealth across generations isn’t about big numbers; it’s about smart systems. I learned this the hard way when family misunderstandings nearly derailed our future. It’s not just about growing wealth, but protecting it, sharing it fairly, and making sure it lasts. Without clear communication and structure, even substantial assets can dissolve into conflict, resentment, or mismanagement. The truth is, money alone cannot carry a family forward. What truly endures is a foundation built on trust, clarity, and shared purpose—a system designed not just to transfer wealth, but to sustain it across lifetimes.

The Hidden Challenge Behind Inheritance

Inheritance is often viewed as a legal event—something that happens after a death, marked by the reading of a will and the distribution of assets. But in reality, the process begins much earlier, shaped by years of unspoken assumptions, emotional dynamics, and informal expectations. Many families assume that having a will is enough, yet they overlook the deeper challenges that arise when money intersects with relationships. Disputes over perceived favoritism, unclear intentions, or unequal involvement in family businesses can fracture even the closest bonds. These tensions are not rare exceptions—they are predictable outcomes when wealth transfer is treated as a technical matter rather than a relational one.

Consider the case of a successful entrepreneur who built a business from the ground up. He left his estate equally divided among his three children, believing this would ensure fairness. But one child had worked alongside him for decades, while the other two remained uninvolved. The result? Resentment grew quickly. The active child felt their contribution was disregarded, while the others felt excluded from understanding the business’s value. What began as an intention to promote equality ended in prolonged legal disputes and broken communication. This scenario illustrates a common flaw: confusing legal simplicity with emotional intelligence. When families fail to discuss roles, contributions, and expectations ahead of time, they leave room for interpretation—and conflict.

The root issue lies in silence. Too often, parents avoid talking about money out of fear of creating dependency, encouraging greed, or revealing disparities in their plans. But avoidance does not prevent tension—it delays it, often until a moment of grief or transition when emotions are most fragile. Research consistently shows that families who communicate openly about wealth, even in difficult conversations, are far more likely to preserve both their financial assets and their relationships. Transparency builds trust, and trust becomes the foundation upon which sustainable legacies are built. Without it, even the most carefully drafted legal documents cannot prevent misunderstandings.

Therefore, the first step in effective legacy planning is not selecting an executor or choosing a trustee—it is opening a dialogue. This conversation should not be a one-time event but part of an ongoing process that evolves as the family grows. It involves listening as much as speaking, understanding each member’s hopes and concerns, and acknowledging that financial decisions carry emotional weight. By treating inheritance as a living process rather than a static transaction, families can move beyond the myth of simplicity and embrace the complexity of human relationships. The goal is not to eliminate differences but to manage them constructively, ensuring that wealth serves to unite rather than divide.

Wealth as a Living System, Not Just an Estate

Traditionally, estate planning has focused on the mechanics of asset transfer—drafting wills, setting up trusts, minimizing taxes. While these elements are essential, they represent only the outer shell of what a true financial legacy requires. A more powerful approach views wealth as a living system: dynamic, adaptive, and guided by principles that extend beyond balance sheets. In this framework, money is not merely accumulated and passed down; it is stewarded, invested with intention, and aligned with family identity. This shift in perspective transforms wealth from a finite resource into a continuing force capable of supporting multiple generations.

A wealth system operates through interconnected components—governance structures, shared values, decision-making protocols, and educational practices—that work together to maintain stability and purpose. One example is the use of family councils, where members across generations meet regularly to discuss financial matters, review investments, and align on long-term goals. These gatherings do more than exchange information; they reinforce a sense of collective responsibility. When younger members participate in discussions about philanthropy or business strategy, they begin to see themselves not just as beneficiaries, but as custodians of something larger than themselves. This fosters accountability and reduces the risk of entitlement, which is a leading cause of wealth erosion over time.

Another key feature of a living wealth system is the integration of values into financial decisions. For instance, a family might establish guidelines that direct a portion of investment returns toward causes they collectively care about—education, environmental sustainability, or community development. These rules are not arbitrary restrictions; they serve as anchors that preserve meaning and continuity. They answer the question: “What kind of impact do we want our wealth to have?” By embedding ethical considerations into financial behavior, families create a culture where money is used as a tool for purpose, not just personal gain.

Flexibility is also critical. Economic conditions change, family circumstances evolve, and new opportunities emerge. A rigid plan may work in the short term but fail when unexpected events occur—such as market downturns, health crises, or shifts in family dynamics. A resilient wealth system anticipates change by building in review cycles, allowing for adjustments without undermining core principles. This might include periodic evaluations of trust structures, updates to governance roles, or revisions to spending policies based on changing needs. The goal is not perfection, but adaptability—ensuring that the system remains relevant and effective across decades.

Ultimately, viewing wealth as a system shifts the focus from control to continuity. Instead of asking, “How do I keep my money safe?” families begin to ask, “How do I ensure this wealth continues to serve our values and strengthen our unity?” This mindset change is subtle but profound. It moves legacy planning from a defensive posture—protecting against loss—to an active, forward-looking endeavor. When wealth is managed as a living entity, it gains the capacity to grow not only financially but also in influence, wisdom, and cohesion.

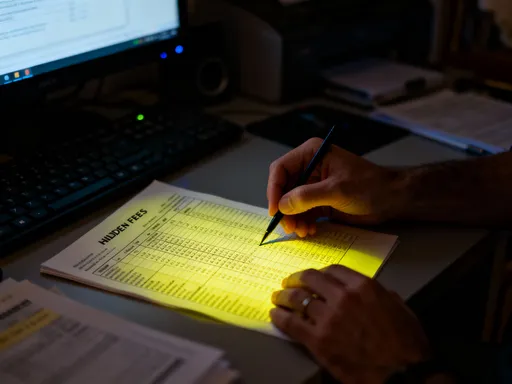

Protecting Value Before Passing It On

One of the most overlooked aspects of legacy planning is the period before inheritance occurs—the years when wealth is actively managed and vulnerable to erosion. Many families assume that building a fortune is the hardest part, and once achieved, preservation is automatic. But without deliberate strategies, even well-structured estates can lose significant value due to taxes, market volatility, legal disputes, or poor management. The reality is that what heirs ultimately receive depends less on the initial size of the estate and more on how effectively it was protected during the accumulation and transition phases.

Asset diversification stands as one of the most fundamental protective measures. Concentrating wealth in a single business, property, or investment class exposes the family to disproportionate risk. If that asset declines in value—or becomes entangled in litigation—the entire legacy may be compromised. A balanced portfolio, spread across different asset types such as equities, fixed income, real estate, and alternative investments, helps absorb shocks and maintain stability. Moreover, geographic diversification can reduce exposure to regional economic downturns or regulatory changes. These choices are not about maximizing returns at all costs, but about ensuring resilience in the face of uncertainty.

Tax efficiency is another crucial element. Governments impose various taxes on wealth transfers, including estate, gift, and capital gains taxes. While these obligations are inevitable, they need not be excessive. Strategic planning—such as gifting assets during life, utilizing annual exclusion limits, or establishing irrevocable trusts—can significantly reduce the tax burden on heirs. For example, transferring appreciating assets before death allows beneficiaries to inherit them at a stepped-up cost basis, potentially minimizing capital gains liability. These techniques require foresight and coordination with legal and tax professionals, but the long-term savings can be substantial.

Beyond market and tax risks, families must also guard against internal threats—particularly disputes among members. Conflict can drain resources through legal fees, forced sales of assets, or breakdowns in business operations. To mitigate this, some families adopt preemptive governance tools, such as shareholder agreements for family-owned businesses or mediation clauses in trust documents. These mechanisms do not prevent disagreements—they provide structured ways to resolve them without escalating into costly battles. Clarity in roles, decision rights, and exit strategies helps maintain order even during times of tension.

Additionally, insurance plays a strategic role in wealth protection. Life insurance, in particular, can serve as a liquidity source to cover estate taxes or equalize inheritances without requiring the sale of core assets. Umbrella liability policies protect against personal claims that could otherwise attach to family wealth. These instruments are not speculative; they are risk management tools designed to preserve capital. When integrated into a broader protection strategy, they add a layer of security that allows the family to focus on long-term goals rather than reactive crisis management.

The takeaway is clear: protection is not a one-time action but an ongoing discipline. It requires regular reviews, updates to legal structures, and engagement with trusted advisors. Most importantly, it demands awareness—recognizing that threats to wealth come not only from external forces but also from within the family itself. By addressing these risks proactively, families increase the likelihood that what they pass on reflects not just what they earned, but what they managed to preserve.

Fairness vs. Equality: Designing Distribution That Works

One of the most emotionally charged aspects of legacy planning is how assets are distributed among heirs. The instinct for many parents is to divide everything equally, believing this ensures fairness and prevents conflict. However, equal division does not always lead to equitable outcomes—especially when family circumstances, contributions, or responsibilities differ. Treating everyone the same may feel fair on the surface, but it can ignore important nuances that, if unaddressed, breed resentment and long-term division.

Consider a family where one child has taken over the management of a parent’s business, dedicating years to its growth while sacrificing other career opportunities. Meanwhile, siblings pursued different paths and remained uninvolved. If the estate is split equally, the working child may feel their effort and commitment were not recognized. Conversely, if the business is left entirely to that child, others may perceive it as exclusionary. In such cases, equality fails to account for contribution, need, or future responsibility. A more thoughtful approach considers fairness as a broader concept—one that balances financial distribution with recognition, opportunity, and long-term harmony.

To achieve this balance, many families adopt customized distribution models. One common strategy is the use of conditional trusts, which release funds based on milestones such as age, education completion, or career achievement. This approach encourages responsibility and discourages dependency, ensuring that inheritances support growth rather than hinder it. Another method is staggered distribution, where assets are transferred in phases—perhaps one-third at age 30, one-half at 35, and the remainder at 40. This allows time for maturity to develop and reduces the risk of impulsive decisions with large sums of money.

Non-financial recognition is equally important. A parent can affirm a child’s role through written letters, public acknowledgment at family gatherings, or inclusion in governance roles, even if their financial share differs. These gestures validate effort and strengthen emotional bonds. Similarly, some families choose to equalize non-cash assets through buy-sell agreements or life insurance payouts, ensuring that those who do not inherit the business still receive comparable value. The key is transparency—explaining the reasoning behind decisions so that all parties understand the intent and feel heard.

Ultimately, the goal is not to avoid difficult conversations but to have them early and with compassion. When parents articulate their values, acknowledge differences in contribution, and involve children in discussions about distribution, they model fairness as a process rather than a formula. This builds trust and reduces the likelihood of conflict down the line. A well-designed distribution plan does not eliminate all tension—it provides a framework for navigating it with dignity and respect. By prioritizing fairness over mere equality, families lay the groundwork for a legacy that honors both individuality and unity.

Teaching the Next Generation Early

Perhaps the greatest threat to intergenerational wealth is not market risk or taxation, but unprepared heirs. Studies have shown that a significant percentage of family fortunes disappear by the second or third generation, not because the money was lost in bad investments, but because beneficiaries lacked the knowledge, discipline, or mindset to manage it wisely. Wealth without financial literacy becomes a burden rather than a blessing. Therefore, one of the most impactful actions parents and elders can take is to begin financial education early—not as formal lessons, but as integrated, age-appropriate experiences that build competence and character over time.

For young children, this might mean simple conversations about saving, giving, and earning. A weekly allowance tied to small responsibilities teaches the connection between effort and reward. Opening a savings account in their name introduces basic banking concepts and the power of compounding. As children grow, discussions can expand to include budgeting, charitable giving, and the difference between needs and wants. These early habits form the foundation of financial responsibility, shaping attitudes that last a lifetime.

In adolescence and young adulthood, the focus shifts toward real-world application. Some families establish small investment funds for each child, allowing them to make decisions with guidance from parents or advisors. This hands-on experience—choosing stocks, reviewing performance, learning from mistakes—builds confidence and judgment. Others involve older teens in family meetings where budgets, charitable grants, or business updates are discussed. Participation fosters a sense of ownership and helps younger members understand the complexity behind wealth management.

Mentorship plays a vital role as well. When a grandparent shares stories about starting a business, overcoming setbacks, or making ethical choices under pressure, they transmit values that no textbook can teach. These narratives connect money to meaning, showing that wealth is not an end in itself but a means to support purpose, security, and contribution. Over time, heirs begin to see themselves not as passive recipients, but as stewards entrusted with a responsibility to preserve and grow what they inherit—not just financially, but morally.

The ultimate goal of financial education is not to produce investment experts, but to cultivate wisdom. That includes humility—the awareness that wealth comes with obligations. It includes resilience—the ability to handle both success and loss with grace. And it includes generosity—the understanding that true prosperity is measured not only by what one keeps, but by what one gives. When these qualities are nurtured from an early age, the likelihood of long-term stewardship increases dramatically. Education, in this sense, is the most powerful tool a family can use to ensure its legacy endures.

Tools That Make the System Work

Even the most thoughtful intentions require structure to become reality. Without the right tools, a family’s legacy plan remains vulnerable to misinterpretation, inefficiency, or failure. Fortunately, a range of legal and financial instruments exists to support long-term wealth continuity. When used appropriately, these tools provide clarity, enforce accountability, and ensure that the family’s vision is carried out—regardless of changing circumstances or emotional challenges.

Trusts are among the most versatile mechanisms available. Unlike wills, which become public records after death, trusts allow for private, controlled distribution of assets. Revocable living trusts offer flexibility during the grantor’s lifetime, while irrevocable trusts provide stronger protection against creditors and estate taxes. More importantly, trusts can be designed with specific instructions—such as distributing funds in stages, supporting education expenses, or funding charitable initiatives. They serve not only as legal containers for wealth but as vehicles for values, ensuring that financial decisions align with family goals long after the original planners are gone.

Equally important is the family constitution—a written document that outlines shared principles, governance rules, and expectations for future generations. While not legally binding, it functions as a moral compass, guiding behavior and resolving disputes. It might include statements on work ethic, requirements for involvement in family enterprises, or guidelines for accessing trust funds. By articulating these norms collectively, families create a shared reference point that reduces ambiguity and strengthens unity. The process of drafting a constitution is often as valuable as the final product, as it requires open dialogue and mutual agreement.

Family advisory boards are another effective tool, especially for larger or more complex estates. Composed of family members, independent advisors, and sometimes professional directors, these boards oversee investment strategies, review financial performance, and mediate disagreements. Their presence introduces objectivity and expertise, preventing decisions from being driven solely by emotion or short-term interests. Regular meetings foster transparency and accountability, ensuring that all stakeholders remain informed and engaged.

No single tool works for every family. What matters most is customization—aligning mechanisms with the family’s unique dynamics, values, and goals. A small family with modest assets may benefit most from a simple trust and open communication, while a multi-generational business-owning family might require a full governance structure. The key is not complexity, but fit. Tools should serve the system, not complicate it. When chosen wisely and implemented thoughtfully, they become the scaffolding that holds a legacy together, allowing it to stand strong across time.

Building a Legacy That Lasts Beyond Finances

A truly enduring legacy extends far beyond bank statements and property deeds. While financial security is essential, it is the intangible elements—values, stories, traditions, and shared purpose—that give wealth its deepest meaning. These cultural assets are not inherited through documents; they are passed down through relationships, rituals, and intentional acts of transmission. When families invest in this dimension of legacy, they ensure that future generations do not merely possess wealth, but understand it, respect it, and use it wisely.

One powerful way to embed values into financial life is through purpose-driven giving. Establishing a family foundation or donor-advised fund allows members to collaborate on charitable decisions, reinforcing a sense of unity and mission. Whether supporting local schools, funding medical research, or aiding environmental causes, these acts teach heirs that wealth carries responsibility. Over time, philanthropy becomes not just a transaction, but a tradition—one that connects the family to something greater than itself.

Personal narratives also play a crucial role. A letter from a parent explaining why they valued hard work, how they handled failure, or what they hope for their descendants can have a lasting impact. These messages, read years later, often resonate more deeply than any financial instruction. Similarly, recording oral histories, preserving family photographs, or maintaining journals ensures that the human story behind the wealth is not lost. When heirs know where they come from, they are more likely to honor what they’ve been given.

Rituals strengthen continuity. Annual family retreats, milestone celebrations, or even regular dinners create space for connection and reflection. During these gatherings, financial updates can be shared, values reaffirmed, and younger members welcomed into the circle of stewardship. These moments build identity and belonging, reminding everyone that they are part of a larger journey. Over time, the family becomes not just a group that shares assets, but a community bound by shared history and common purpose.

In the end, the measure of a successful legacy is not the size of the fortune, but the strength of the family. It is seen in the way members support one another, make decisions with integrity, and navigate challenges with resilience. A well-structured financial plan ensures that resources are preserved, but it is the cultivation of trust, wisdom, and unity that ensures they are used well. By building a system that honors both numbers and narratives, families can pass down more than money—they can pass down the quiet confidence that comes from knowing the future is prepared, and that they are ready to meet it together.