Spa Savings Secrets: How I Turned Self-Care Into Smart Investing

Ever felt guilty about splurging on spa days? I did—until I realized those costs could actually fuel smarter financial habits. What if pampering yourself wasn’t a drain, but a trigger for better money moves? This is the story of how tracking my spa spending uncovered powerful investment tools, reshaped my budget, and helped me grow wealth without sacrificing self-care. What began as a simple effort to understand my monthly expenses turned into a transformative financial strategy—one that honors both personal well-being and long-term prosperity. The journey revealed that small, consistent choices, when aligned with intention, can generate lasting results.

The Hidden Cost of Relaxation

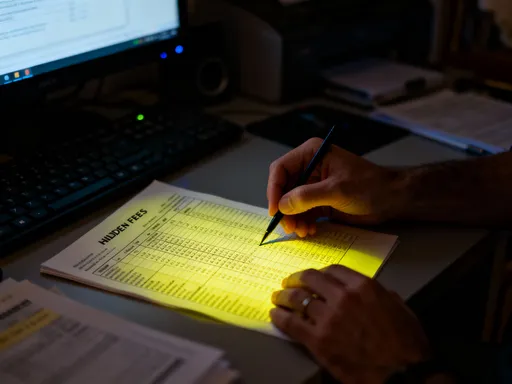

At first glance, a monthly massage or facial seems like a harmless indulgence. For many women between 30 and 55, these moments of calm are essential—a retreat from busy households, caregiving responsibilities, and professional demands. Yet, when examined closely, these recurring wellness expenses can quietly accumulate. A $90 massage every four weeks adds up to over $1,000 a year. Add in facials, manicures, and aromatherapy sessions, and the total can easily surpass $2,000 annually—money that, if redirected thoughtfully, could seed a meaningful investment portfolio.

The issue is not the value of self-care, but the invisibility of its cost. Many individuals overlook these expenses because they fall outside traditional budget categories like rent or groceries. They’re seen as occasional treats, not regular commitments. This misperception leads to a distorted financial picture, where discretionary spending feels minor even as it drains resources over time. The emotional relief these services provide can mask their financial impact, making it easy to justify repeated visits without assessing long-term consequences.

Recognizing this pattern is the first step toward financial clarity. When spa visits are treated as routine rather than rare, they become visible data points in a larger financial narrative. This awareness does not require guilt or deprivation. Instead, it invites a shift in perspective: these expenses are not inherently wasteful, but they do demand intentionality. By acknowledging their true cost, individuals gain the power to make informed decisions—not just about where money goes, but how it can be used to support both immediate well-being and future security.

From Expense Tracking to Financial Clarity

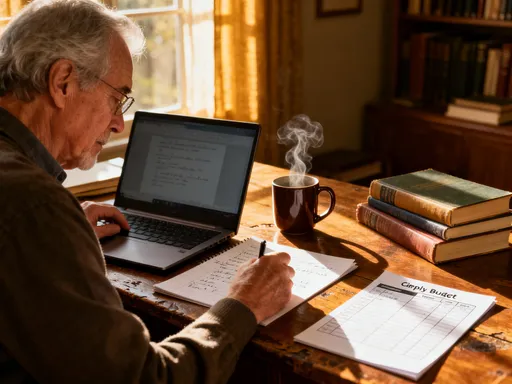

Once the true cost of relaxation became clear, the next step was systematic tracking. Digital budgeting tools like Mint, YNAB (You Need A Budget), and personal finance features within banking apps made it possible to categorize every spa-related transaction with precision. These platforms automatically log purchases, assign them to custom categories like “Wellness” or “Personal Care,” and generate monthly summaries. Over time, trends emerged: spending spiked during high-stress seasons, such as back-to-school months or holiday preparations. This correlation between emotional state and spending behavior was eye-opening.

More importantly, tracking revealed a powerful insight—awareness itself changes behavior. Simply recording each expense created a sense of accountability. It wasn’t about eliminating spa visits, but about understanding their role in the broader financial ecosystem. When a $120 facial appeared in a monthly report alongside mortgage and utility payments, it prompted reflection: Was this expense aligned with personal values? Could it be balanced with forward-looking financial goals?

The process also highlighted the limitations of traditional budgeting models. Many budget templates emphasize cutting “unnecessary” spending, but this approach often fails because it ignores emotional drivers. Instead of suppressing self-care, a more effective strategy is integration—acknowledging that wellness spending serves a real psychological need while ensuring it doesn’t come at the expense of financial stability. By shifting from judgment to observation, individuals can transform guilt into strategy, using data to design budgets that reflect both practical needs and emotional well-being.

Automated categorization tools further enhanced this clarity. When every self-care purchase was grouped and visualized in a monthly dashboard, it became easier to set realistic limits. For instance, seeing that wellness spending averaged $150 per month allowed for intentional planning—allocating that amount in advance rather than reacting impulsively. This proactive approach reduced financial stress and created space for deliberate decision-making, laying the foundation for smarter money management.

Reframing Wellness Spending as a Financial Catalyst

With a clear picture of spending patterns, the next breakthrough was redefining the role of self-care in financial planning. Rather than viewing spa visits as financial leaks, they were reframed as behavioral benchmarks—predictable, recurring events that could anchor disciplined saving. The idea was simple: for every dollar spent on personal wellness, a corresponding amount could be directed toward long-term growth. This “mirror strategy” transformed indulgence into investment, creating a direct link between enjoyment and financial progress.

For example, if a massage costs $100, an automatic transfer of $100 to an investment account could be triggered on the same day. This is not about doubling expenses, but about matching them with equal financial intention. The psychological effect is powerful—each act of self-care becomes a catalyst for wealth-building. Over time, this practice fosters a balanced relationship with money, where taking care of oneself also means taking care of one’s future.

The concept draws from behavioral economics, which shows that people are more likely to stick to financial goals when they are tied to existing habits. By linking a pleasurable activity like a spa day to an abstract goal like retirement savings, the latter becomes more tangible and emotionally rewarding. This method avoids the austerity often associated with financial discipline, replacing sacrifice with symmetry. It acknowledges that well-being matters, while ensuring that financial health is not neglected in the process.

Additionally, this approach encourages mindfulness. Before booking a treatment, individuals may pause to consider whether the expense fits within their overall plan. This reflective moment reduces impulsive spending and strengthens financial agency. The goal is not perfection, but progress—building a system where self-care and financial responsibility coexist harmoniously, each reinforcing the other.

Investment Tools That Work With Your Lifestyle

Implementing the mirror strategy requires accessible, low-barrier investment tools. Fortunately, modern fintech platforms have made it easier than ever to start investing with small amounts. Robo-advisors like Betterment and Wealthfront offer automated portfolio management with low minimums and transparent fee structures. These services use algorithms to build diversified portfolios based on risk tolerance and time horizon, eliminating the need for extensive financial knowledge.

Micro-investing apps such as Acorns and Stash take this a step further by rounding up everyday purchases and investing the spare change. While this model works well for incidental spending, it can be adapted for intentional transfers. For instance, instead of relying on round-ups, users can set up manual transfers of fixed amounts—like the cost of a spa visit—directly into their investment accounts. This gives greater control and aligns more closely with planned spending habits.

Exchange-traded funds (ETFs) are another key component of this strategy. These investment vehicles bundle a variety of assets—such as stocks, bonds, or commodities—into a single, tradable unit. Many ETFs track broad market indices, offering instant diversification and historically strong long-term returns. Because they are low-cost and highly liquid, ETFs are ideal for individuals who want to grow wealth steadily without engaging in high-risk trading.

The real power of these tools lies in automation. Once set up, transfers can occur seamlessly, requiring no daily decision-making. This “set-it-and-forget-it” approach reduces emotional interference and ensures consistency. Over time, even modest monthly contributions can grow significantly due to compound interest. For example, investing $100 per month at an average annual return of 7% would yield over $23,000 in 10 years. The key is regularity, not size—the habit matters more than the amount.

Building a Self-Care Investment Strategy

A personalized self-care investment strategy begins with intention and structure. The first step is defining what constitutes “wellness spending”—whether it’s massages, yoga classes, skincare products, or quiet retreats. Once categorized, these expenses are tracked over a three-month period to establish an average monthly total. This number becomes the foundation for the investment match.

Next, an investment account is designated specifically for this purpose. It could be a taxable brokerage account, a Roth IRA, or a dedicated savings fund, depending on financial goals and tax considerations. The chosen platform should support automatic transfers and offer low fees to maximize growth potential. Linking the investment account to the same bank used for wellness purchases streamlines the process.

The core mechanism is a one-to-one transfer: each time a wellness expense is made, an equal amount is moved into the investment account. To maintain balance, some may choose a partial match—such as 50%—if full parity feels too ambitious. The goal is sustainability, not perfection. The psychological benefit is significant: every act of self-nurturing is mirrored by an act of financial nurturing, reinforcing a positive feedback loop.

This strategy also promotes accountability. Seeing the investment balance grow alongside wellness spending creates a sense of achievement. It shifts the narrative from “I’m spending too much” to “I’m building something valuable.” Over time, the investment account becomes a visible symbol of progress—a financial reflection of self-respect. Case studies show that individuals who adopt this method often report increased confidence in their financial decisions and a deeper sense of control over their money.

Moreover, this approach supports long-term goals such as retirement, home ownership, or education funding. The funds accumulated through matched transfers can be directed toward these objectives, making abstract aspirations more concrete. Because the contributions are tied to enjoyable experiences, the saving process feels less like a burden and more like a natural extension of self-care.

Risk Awareness and Realistic Expectations

While the self-care investment strategy is empowering, it is essential to approach investing with realistic expectations. Financial markets are inherently volatile—returns are not guaranteed, and values can fluctuate from year to year. Historical averages suggest that broad market indices have returned about 7% annually over the long term, but individual results will vary. Periods of decline are normal and expected, not signs of failure.

Diversification is a critical safeguard. By spreading investments across different asset classes—such as domestic and international stocks, bonds, and real estate—investors reduce the risk of significant losses. Robo-advisors and ETFs typically provide built-in diversification, making it easier for beginners to avoid overexposure to any single sector. This reduces emotional decision-making, such as selling during a downturn out of fear.

Time horizon is another crucial factor. The longer money remains invested, the greater its potential to recover from market dips and benefit from compounding. For women in their 30s and 40s, this is particularly advantageous—there is often enough time to ride out volatility and achieve meaningful growth. Even those in their 50s can benefit, as consistent contributions in the final decade before retirement can significantly boost savings.

Education is the foundation of sustainable success. Rather than chasing quick gains or reacting to market headlines, investors should focus on understanding basic principles—compound interest, asset allocation, and tax efficiency. Many platforms offer free resources, including webinars, articles, and financial calculators, to help users build confidence. The goal is not to become a financial expert, but to make informed choices aligned with personal goals.

Patience, not timing, drives results. Studies consistently show that investors who stay the course outperform those who try to time the market. By committing to regular contributions—regardless of market conditions—individuals harness the power of dollar-cost averaging, buying more shares when prices are low and fewer when prices are high. This disciplined approach smooths out volatility and supports long-term wealth accumulation.

Turning Habits Into Wealth: A New Financial Mindset

The journey from tracking spa expenses to building a sustainable investment habit reveals a profound truth: financial health and personal wellness are not opposing forces. They are interconnected dimensions of a balanced life. When money is managed with intention, it becomes a tool for both present comfort and future security. The self-care investment strategy exemplifies this synergy—transforming routine spending into a disciplined, empowering practice.

This mindset shift is especially powerful for women who have traditionally been excluded from financial conversations or conditioned to prioritize others’ needs over their own. By aligning spending with values, they reclaim agency over their financial lives. Each spa visit, once a source of guilt, becomes a deliberate act of self-worth—matched by an investment that honors their future self.

The strategy is not about austerity or denial. It does not require giving up what brings joy. Instead, it invites a deeper level of awareness—using existing habits as a foundation for growth. Over time, small, consistent actions compound into significant outcomes, both financially and emotionally. The investment balance grows, but so does confidence, resilience, and peace of mind.

True wealth is not measured solely by account balances, but by the freedom to live with intention. It is the ability to care for oneself today while building security for tomorrow. By integrating self-care and smart investing, individuals create a sustainable financial rhythm—one that supports well-being at every stage of life. This is not a shortcut to riches, but a lasting path to prosperity grounded in balance, discipline, and self-respect.