How I Secured My Golden Years for Stress-Free Senior Travel

What if your retirement fund could grow steadily while you’re sipping coffee in Italy or hiking through the Swiss Alps? I used to worry about money limiting my travel dreams—until I shifted my strategy. It wasn’t about chasing high returns; it was about return stability. By focusing on predictable income and low-risk allocations, I built a portfolio that supports regular adventures—without sleepless nights. This is how I made it work.

The Traveler’s Dilemma: Stability Over Speed

For many retirees, the dream of global exploration is real. The idea of wandering through ancient cities, tasting local dishes in coastal villages, or tracing historic trails brings joy and renewal. Yet, too often, that dream is derailed not by health or energy—but by financial uncertainty. Market volatility, unpredictable income, and the fear of outliving savings create stress that shadows even the most beautiful destinations. The core issue isn’t a lack of savings; it’s the structure of those savings. Too many retirees assume that because they’re no longer working, their investments must work harder. This mindset leads to aggressive strategies—high-growth stocks, speculative ventures, or concentrated bets on single sectors—all in the name of maximizing returns. But in retirement, especially for those who wish to travel, the priority shifts from accumulation to preservation and reliable income.

Chasing high returns in later years carries hidden costs. A portfolio that swings wildly in value can force retirees to sell assets at a loss just to cover basic expenses or fund a planned trip. This is known as sequence-of-returns risk—the danger that early downturns in retirement can permanently damage long-term financial health. Imagine planning a six-week tour of Japan, only to see your portfolio drop 20% in the months before departure. Faced with that reality, many retirees cancel or downgrade their plans, not because they lack funds overall, but because they lack accessible, stable funds at the right time. The emotional toll is just as significant: the anxiety of checking account balances before every booking, the hesitation before upgrading to a scenic train route, or the constant second-guessing of whether the next trip is “worth it.”

A stability-focused strategy addresses these concerns by prioritizing consistency over speed. Instead of aiming for 10% annual returns with high risk, the goal becomes 4% to 6% with minimal downside. This modest growth is often enough to outpace inflation and support ongoing travel, especially when paired with disciplined spending. The peace of mind that comes from knowing your income is predictable—like a pension or rental check—allows you to book flights and reserve lodgings without hesitation. It transforms travel from a luxury that feels risky to a sustainable part of your lifestyle. This doesn’t mean abandoning growth entirely; it means balancing growth assets with income-producing ones in a way that aligns with your risk tolerance and life goals.

Building a Foundation: Assets That Work While You Wander

A reliable retirement portfolio for travelers functions like a well-built home: strong foundation, durable materials, and thoughtful design. It’s not flashy, but it stands firm through seasons and storms. The foundation of such a portfolio rests on three pillars: capital preservation, consistent income, and moderate growth. These are achieved through a mix of dividend-paying equities, high-quality bonds, and alternative income sources that generate cash flow without requiring active labor. Unlike speculative investments that depend on market timing or rapid price appreciation, these assets are chosen for their ability to deliver steady returns over time, regardless of short-term market noise.

Dividend-paying stocks from established companies form a key part of this foundation. These are not trendy startups or high-flying tech firms, but mature businesses with a long history of profitability and shareholder payouts. Think of global companies in sectors like consumer staples, utilities, or healthcare—industries that people rely on every day, in every country. These firms often increase their dividends annually, providing a built-in hedge against inflation. For a retiree who travels, this means the income stream grows gradually, helping maintain purchasing power whether shopping in Lisbon or dining in Bangkok. The key is selecting companies with strong balance sheets and sustainable payout ratios, not just high yields. A yield that looks attractive today may collapse tomorrow if the company is overextending itself.

Bonds, particularly government and investment-grade corporate bonds, add another layer of stability. They offer fixed interest payments at regular intervals, which can be aligned with travel planning cycles—say, every quarter or every six months. Short- to intermediate-duration bonds are especially useful because they are less sensitive to interest rate changes than long-term bonds. This reduces the risk of principal loss when rates rise, a common concern for retirees who may need to access funds soon. While bond yields may seem low compared to stock returns, their predictability is invaluable. They act as ballast in the portfolio, offsetting equity volatility and ensuring that not all income depends on market performance.

Alternative income sources, such as real estate investment trusts (REITs) or infrastructure funds, can further diversify income streams. These assets often pay higher distributions and are tied to real-world usage—like shopping centers, apartment buildings, or toll roads—making them resilient over time. For travelers, the benefit is twofold: these investments often operate globally, providing exposure to multiple economies, and their income is typically paid in stable currencies. When combined thoughtfully, these assets create a portfolio that works quietly in the background, generating cash flow that funds adventures without requiring constant monitoring or risky decisions.

Income Streams That Keep Up With Your Passport Stamps

Travel in retirement isn’t a one-time splurge; it’s a recurring rhythm. Whether it’s an annual European tour, seasonal escapes to warmer climates, or spontaneous trips to visit family abroad, the need for income is ongoing. This reality demands a financial structure that delivers regular, reliable cash flow—ideally in multiple currencies or with built-in protection against exchange rate swings. A single lump sum or irregular payouts won’t suffice. Instead, retirees need a system of income streams that mimic the predictability of a paycheck, even in the absence of employment.

Annuities are one tool that can provide this kind of certainty. A fixed or indexed annuity, purchased from a reputable insurance company, can offer guaranteed monthly payments for life. While they lack the growth potential of stocks, they eliminate the risk of outliving your money—a critical concern for long-term travelers. Some retirees allocate a portion of their savings to an annuity to cover basic living expenses, freeing up the rest of their portfolio to fund discretionary spending like travel. Immediate annuities start paying right away, while deferred annuities can be set up years in advance to begin at a chosen date, such as retirement. The trade-off is liquidity—once the money is in, it’s generally not accessible—but for those who value security, this can be a worthwhile compromise.

Rental properties, whether owned directly or through real estate funds, offer another steady income source. A well-located property in a tourist-friendly city can generate monthly rent that covers airfare or hotel stays. Even if the property isn’t in a vacation spot, the income can be redirected to travel budgets. The key is choosing locations with stable demand and manageable maintenance costs. For retirees who travel frequently, direct ownership may be less practical than investing in real estate funds or REITs, which offer diversification and professional management. These funds distribute income regularly and can be held in retirement accounts, making them easy to integrate into a broader financial plan.

Structured withdrawal strategies also play a crucial role. Instead of withdrawing a fixed dollar amount each year, which can deplete a portfolio during downturns, many retirees use a percentage-based approach—taking, for example, 4% of the portfolio’s value annually. This method automatically adjusts for market performance, reducing withdrawals when values fall and allowing for modest increases when they rise. Another approach is the “bucket” strategy, where funds are divided into short-, medium-, and long-term accounts. The short-term bucket holds cash and cash equivalents to cover 1–3 years of expenses, including travel, so there’s no need to sell stocks during a market dip. The medium bucket might include bonds and dividend funds, while the long-term bucket holds growth-oriented assets. This structure provides both flexibility and protection, ensuring that travel plans aren’t derailed by temporary market conditions.

Risk Control: Avoiding the Traps That Empty Travel Funds

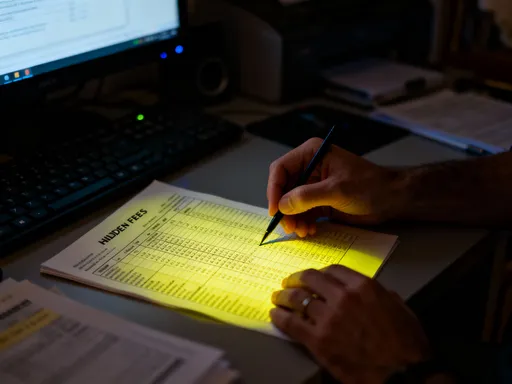

Even small financial missteps can have outsized consequences when you’re living abroad or planning frequent trips. Currency fluctuations, for instance, can erode purchasing power quickly. A retiree relying on U.S. dollars to spend in Europe may find that a weakening dollar makes hotels and meals significantly more expensive. This isn’t just an inconvenience—it can force changes to travel itineraries or reduce the length of stays. To manage this risk, some investors allocate a portion of their portfolio to international bonds or global dividend funds that pay in foreign currencies. This provides natural hedging, as income rises when the dollar falls. Others use currency-hedged funds, which are designed to minimize the impact of exchange rate changes. While perfect protection is impossible, even partial hedging can reduce stress and improve budget predictability.

Sequence-of-returns risk, mentioned earlier, is another major threat. If a retiree experiences a market downturn in the first few years of withdrawal, the damage can be long-lasting. Selling assets at low prices locks in losses and reduces the portfolio’s ability to recover. This risk is especially dangerous for travelers, who may have higher-than-average withdrawal needs during peak travel years. One way to mitigate this is by maintaining an emergency reserve in stable, liquid assets—such as high-yield savings accounts, money market funds, or short-term CDs. This reserve should cover at least 12 to 24 months of discretionary spending, including travel. It acts as a buffer, allowing retirees to skip withdrawals from the main portfolio during downturns and wait for better market conditions.

Overconcentration is a third trap. Some retirees keep too much of their wealth in their home country’s stock market or in a single company’s stock, often from a former employer. This lack of diversification increases vulnerability to local economic shocks. A downturn in one country can affect both investments and travel plans if that country is a primary destination. A globally diversified portfolio spreads risk across regions and sectors, reducing the impact of any single event. It also opens up opportunities to travel with greater financial confidence, knowing that the portfolio isn’t tied to the fate of one economy. Diversification isn’t about chasing every market; it’s about building resilience through thoughtful allocation.

Smart Withdrawal Tactics: Spending Without Sabotaging Growth

Knowing how much to withdraw—and when—is as important as knowing what to invest in. Withdraw too much, and the portfolio may not last. Withdraw too little, and retirement becomes unnecessarily restrictive. The goal is balance: funding a fulfilling lifestyle without jeopardizing long-term security. Several withdrawal frameworks have been tested over time, each with strengths and limitations.

The flat-rate strategy involves withdrawing a fixed dollar amount each year, adjusted for inflation. It’s simple to manage and provides consistent spending power. However, it doesn’t account for market performance. In a down year, withdrawing the same amount means selling more shares to get the same cash, accelerating portfolio depletion. This can be dangerous in early retirement, when the portfolio has less time to recover.

The percentage-based method—taking a fixed percentage of the portfolio’s current value each year—automatically adjusts for market swings. In a downturn, withdrawals shrink, preserving capital. In a strong year, they increase modestly, allowing for more spending. This approach aligns with the reality that portfolio value fluctuates, and spending should reflect that. However, it can lead to income variability, which may be unsettling for retirees who prefer predictability. To smooth this out, some use a hybrid model: setting a base withdrawal amount and allowing for discretionary “bonuses” in good years.

The bucket strategy, as previously mentioned, divides assets by time horizon. The first bucket—cash and equivalents—covers immediate needs. The second—bonds and income funds—funds the next 3 to 10 years. The third—stocks and growth assets—targets long-term appreciation. Each year, the retiree withdraws from the first bucket, then replenishes it from the second, and so on. This creates a structured, disciplined approach that reduces emotional decision-making. It also allows retirees to travel with confidence, knowing that near-term expenses are covered regardless of market performance.

Timing withdrawals matters, too. Withdrawing during market peaks locks in gains; doing so during dips locks in losses. A disciplined approach—such as scheduling withdrawals at the same time each year or using a rule-based system—helps avoid emotional reactions to market noise. Pairing this with a cash buffer ensures that temporary downturns don’t force sales at the worst possible time.

Real-Life Balancing: Travel Dreams vs. Financial Reality

Consider the case of Margaret, a 68-year-old retiree who travels internationally every year. She and her husband spent decades saving, but early retirement withdrawals felt stressful—until they redesigned their strategy. Their original portfolio was heavily weighted in growth stocks, which performed well in bull markets but dropped sharply in downturns. After a 25% portfolio loss in 2008, they canceled a planned trip to Greece and didn’t travel abroad for three years. Determined to avoid that again, they worked with a financial advisor to build a stability-focused plan.

Today, their portfolio is divided: 40% in high-quality bonds, 35% in dividend-paying stocks, 15% in real estate funds, and 10% in cash and equivalents. They use a bucket strategy, with the cash bucket covering two years of travel and living expenses. They withdraw 4% annually, adjusted downward in down markets. They also receive a small pension and Social Security, which cover basic needs, freeing investment income for discretionary spending. Annuities make up 10% of their assets, providing guaranteed monthly income.

The result? They’ve taken annual trips—to Portugal, Vietnam, Canada, and New Zealand—without depleting their savings. Even during the 2020 market drop, they didn’t sell stocks; they drew from their cash reserve and waited. Their income didn’t spike, but it didn’t collapse either. They’ve learned to plan trips around their withdrawal schedule, booking during stable market periods and avoiding major purchases during volatility. The trade-off is clear: they don’t chase luxury suites or first-class flights, but they enjoy authentic experiences, comfortable stays, and the freedom to explore. Their portfolio isn’t the largest, but it’s the most reliable it’s ever been.

The Long Game: Staying Flexible Without Compromising Safety

Retirement isn’t a single destination; it’s a journey that can last three decades or more. Priorities shift—health needs evolve, family dynamics change, and travel interests may expand or simplify. A sound financial plan must be durable enough to withstand these changes without sacrificing core security. This requires periodic review and adjustment, but not reactive overhauls. Rebalancing the portfolio annually—bringing asset allocations back to target—ensures that growth doesn’t lead to overexposure in risky assets, or fear doesn’t push everything into cash.

Inflation protection is also essential. Over 20 years, even 2% annual inflation cuts purchasing power nearly in half. That’s why a portfolio can’t rely solely on fixed-income assets. Dividend growth stocks, Treasury Inflation-Protected Securities (TIPS), and real assets like real estate help maintain value over time. These aren’t about aggressive returns; they’re about preserving what’s been built.

Discipline, not timing, is the true driver of long-term success. No one can predict markets, but everyone can control their behavior. Sticking to a plan, avoiding emotional reactions, and focusing on process over outcomes leads to better results than trying to outsmart the market. For retirees who travel, this means trusting the system they’ve built—knowing that their money is working quietly, reliably, to support the life they’ve earned.

True financial freedom isn’t measured in dollars, but in confidence. It’s the ability to board a plane without checking your portfolio first. It’s the peace of mind that comes from knowing your income is stable, your risks are managed, and your dreams are within reach. By focusing on return stability, not just return size, retirees can turn their golden years into a chapter of exploration, joy, and lasting security. The world is waiting—not just for the wealthy, but for those who plan wisely.