How I Nearly Sabotaged My Child’s Future — And What I Learned About Smart Investing

We all want the best for our kids, especially when it comes to education. I thought I was being responsible by chasing high returns on my child’s education fund—until a close call taught me the hard way. I learned that emotions, impatience, and shortcuts can quietly wreck long-term goals. This is my story of falling into common financial traps and slowly rebuilding a smarter, calmer investment mindset. What began as a well-intentioned effort to secure my child’s future nearly backfired because I misunderstood the nature of smart investing. I confused speed with progress, risk with reward, and action with achievement. Like many parents, I equated financial effort with love, believing that doing more—taking bolder steps—would lead to better outcomes. Instead, I exposed my family’s most important goal to avoidable danger. This journey taught me that protecting a child’s future isn’t about dramatic moves or market timing. It’s about discipline, clarity, and patience. And that’s what I want to share—not just what went wrong, but how to build something lasting, stable, and truly effective.

The Dream and the Pressure: Planning for a Child’s Education

For most parents, the idea of funding a child’s education is deeply emotional. It’s not just about tuition or textbooks—it’s about opportunity, dignity, and the hope that the next generation will have more than we did. When my daughter was born, I remember sitting in the hospital hallway, scrolling through college cost projections on my phone. The numbers were staggering. A public university could cost over $100,000 in today’s dollars by the time she enrolled. A private school? Easily double that. I felt a wave of responsibility, almost like a physical weight. I wanted to do everything in my power to make sure she wouldn’t face student debt or have to turn down her dream school because of money. That desire, while noble, became the seed of my financial missteps.

Society amplifies this pressure. From well-meaning relatives asking, “Have you started saving yet?” to financial advisors framing education funding as a benchmark of parenting success, the message is clear: if you love your child, you’ll plan meticulously. Social media doesn’t help. I’ve seen posts showing families who’ve fully funded 529 plans before their baby’s first birthday, or parents boasting about early investments that “will cover everything.” While admirable, these stories often create unrealistic expectations. They suggest that if you’re not already maximizing contributions or picking winning stocks, you’re falling behind. The truth is, most families are doing their best with limited resources, and comparing yourself to outliers only leads to stress and poor decisions.

What I didn’t realize at the time was that this emotional drive could cloud my judgment. I began to see the education fund not just as a savings goal, but as a challenge to be won—something I needed to “beat” through cleverness or effort. That mindset shift was dangerous. Instead of focusing on consistency and safety, I started looking for ways to accelerate growth. I told myself I was being proactive, but in reality, I was responding to fear: fear of not doing enough, fear of rising costs, fear of failing my child. These emotions, left unchecked, made me vulnerable to risky strategies. I wasn’t alone. Studies show that parents saving for education often take on more market risk than they would for retirement, precisely because the timeline feels shorter and the stakes feel higher. But higher risk doesn’t guarantee higher reward—especially when the margin for error is small.

Chasing Returns: When Good Intentions Lead to Risky Bets

It started with a simple search: “best-performing college funds 2023.” I clicked on an article listing mutual funds with double-digit returns, some even above 20%. One fund, focused on technology stocks, had surged in the previous year. I thought, If I put our savings there, we could reach our goal faster. Without consulting a financial advisor or researching long-term performance, I moved a large portion of our education fund into that portfolio. At first, it felt like a win. The balance grew quickly. I even showed my spouse the account statement with pride. But within months, the market shifted. Tech stocks corrected sharply. Our account dropped by nearly 30%. Suddenly, instead of gaining ground, we were behind where we started—and the clock was ticking.

This behavior—chasing past performance—is one of the most common and damaging mistakes in personal finance. Investors see a fund or stock that did well last year and assume it will continue. But financial markets don’t work that way. What performed well recently may be due for a correction, or may have benefited from temporary trends. A study by DALBAR, a financial research firm, found that the average investor underperforms the market by several percentage points annually, largely due to poor timing and emotional decisions. People buy high, sell low, and miss the recovery periods that drive long-term growth. In my case, I bought after the rally and sold during the downturn—essentially the worst possible sequence.

The danger is especially acute when saving for education, because the timeline is fixed. Unlike retirement, which can be delayed, college starts on a set date. If the market is down when your child is ready to enroll, you can’t wait for a rebound. You have to pay—whether the account is up or down. That makes volatility a real threat, not just a theoretical concern. Aggressive investments might offer higher returns over decades, but they also come with greater short-term risk. For a 15- or 18-year horizon, that risk can be manageable early on, but it needs to be scaled back as the goal approaches. I didn’t understand that nuance. I treated the entire timeline as one phase, rather than recognizing that investment strategy should evolve over time. The fund I chose wasn’t inherently bad—it just wasn’t appropriate for my stage or goals.

The Hidden Cost of Impatience: Why Timing Matters More Than Returns

One of the most powerful forces in investing is time. Compounding returns grow exponentially when given enough years to work. A dollar invested at age 5 can be worth ten times more by age 18 than the same dollar invested at age 15, assuming a modest annual return. Yet, many parents—myself included—underestimate this principle. We focus on the rate of return instead of the length of time. We want faster results, so we jump from one investment to another, trying to catch the next big wave. But every switch carries a cost: transaction fees, tax implications, and, most importantly, lost time in the market.

Impatience shows up in many ways. Some parents panic when they see a market dip and pull their money out, locking in losses. Others chase trends—crypto, meme stocks, or hot sectors—believing they’ve found a shortcut. Still others set rigid targets, like “double the fund by age 10,” and feel discouraged when progress is slower than expected. But markets don’t move in straight lines. They rise and fall, sometimes unpredictably. What matters most isn’t avoiding downturns—it’s staying invested through them. Historical data shows that missing just the 10 best days in the stock market over a 20-year period can cut total returns by more than half. Most of those best days occur immediately after the worst days. If you sell during a crash, you miss the recovery.

My own impatience led me to make three costly moves in five years: shifting to aggressive funds, pulling out during a downturn, and reinvesting too late. Each decision was driven by emotion, not strategy. I thought I was being strategic, but I was actually undermining the one advantage I had—time. A more effective approach would have been to stay the course with a balanced portfolio, rebalancing only when necessary, and adjusting risk gradually as my daughter grew older. Instead, I disrupted the compounding process. I learned that discipline is more valuable than cleverness. Consistent contributions, even in small amounts, combined with a stable investment plan, will outperform erratic, high-risk attempts at acceleration. The math is clear: a 6% annual return with no interruptions will beat an 8% return with frequent exits and re-entries.

Confusing Savings with Investing: A Fundamental Mindset Mistake

At the heart of my mistakes was a simple but critical misunderstanding: I treated my child’s education fund like a savings account, but expected it to behave like a stock portfolio. I wanted safety, liquidity, and predictability—hallmarks of savings—but also demanded high growth, which requires risk and volatility. This contradiction set me up for failure. When the market dropped, I was shocked and scared, as if a savings account had lost value. But investments aren’t savings. They’re meant to grow over time, but they do so unevenly. Expecting them to rise every year is like expecting the weather to be perfect every day. It’s not realistic.

Savings and investing serve different purposes. Savings are for short-term needs—emergencies, vacations, or a down payment on a car. They should be kept in low-risk, liquid accounts like high-yield savings or money market funds. The principal is protected, and you can access the money when needed. Investing, on the other hand, is for long-term goals like retirement or education. It involves putting money into assets like stocks, bonds, or mutual funds that can grow over time but may fluctuate in value. The key is matching the investment to the time horizon. For a goal 15 years away, a higher allocation to stocks makes sense. For a goal five years away, a more conservative mix is appropriate.

My error was not adjusting this mix over time. I started with a moderate portfolio but didn’t reduce risk as my daughter approached school age. I also didn’t separate the fund from our emergency savings, which created confusion about how much risk I could truly afford to take. Financial experts often recommend a “glide path” strategy for education funds—starting aggressive and becoming more conservative as the goal nears. This balances growth potential with capital preservation. I ignored that principle, leaving too much exposure to market swings when stability was most important. Recognizing the difference between saving and investing helped me rebuild a more realistic plan—one that respected both the potential and the limitations of the market.

Overcomplicating the Plan: The Trap of “Perfect” Solutions

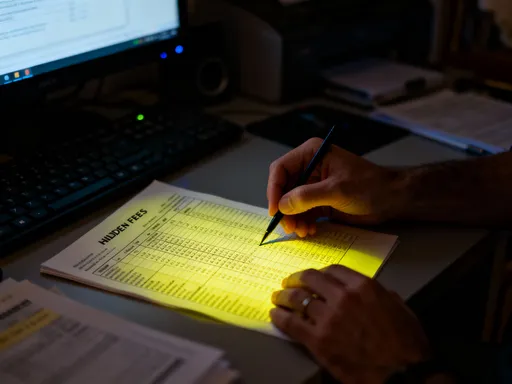

After my early losses, I swung in the opposite direction. I started reading everything I could find about investing. I attended webinars, downloaded spreadsheets, and explored niche financial products—target-date funds, index-linked certificates, even international education trusts. I believed that if I could just find the perfect strategy, I could avoid future mistakes. But the more I researched, the more confused I became. Each expert had a different opinion. Every product came with fine print and fees I didn’t fully understand. I ended up with a portfolio that was too complex to manage, too expensive to maintain, and too fragile to trust.

This is a common trap. People assume that more complexity equals better results. But in finance, simplicity often leads to better outcomes. Complicated plans are harder to stick with, especially during market stress. They also tend to have higher fees—expense ratios, advisory charges, transaction costs—that eat into returns over time. A study by Morningstar found that low-cost funds consistently outperform high-cost funds over the long term, even when they hold similar assets. The difference may seem small—1% per year—but over 18 years, it can reduce final returns by 15% or more.

I finally realized I didn’t need a perfect plan. I needed a good one—one that was easy to understand, low-cost, and aligned with my goals. I simplified my portfolio to a mix of broad-market index funds and bonds, adjusted the allocation based on my daughter’s age, and set up automatic contributions. I stopped chasing exotic products and focused on consistency. The relief was immediate. I no longer felt the need to monitor the market daily or second-guess my choices. I could trust the process because it was transparent and sustainable. Simplicity didn’t mean settling for less. It meant building a foundation that could last, without constant tinkering or anxiety.

Building a Resilient Investment Mindset: Focus, Patience, and Realistic Goals

The most important change I made wasn’t in my portfolio—it was in my mindset. I stopped viewing investing as a performance game and started seeing it as a process. I defined clear, measurable goals: fund 70% of in-state tuition, cover books and housing, and leave room for scholarships or part-time work. I accepted that I might not cover everything, and that was okay. I also acknowledged that I couldn’t control the market, but I could control my behavior. That shift in perspective reduced stress and improved my decision-making.

A resilient investment mindset has three pillars: goal alignment, emotional control, and process over outcomes. Goal alignment means choosing investments that match your timeline and risk tolerance. Emotional control means avoiding impulsive reactions to market noise. Process over outcomes means focusing on consistent actions—like regular contributions and rebalancing—rather than short-term results. These principles don’t guarantee the highest returns, but they protect against the biggest risks: panic, overtrading, and abandonment.

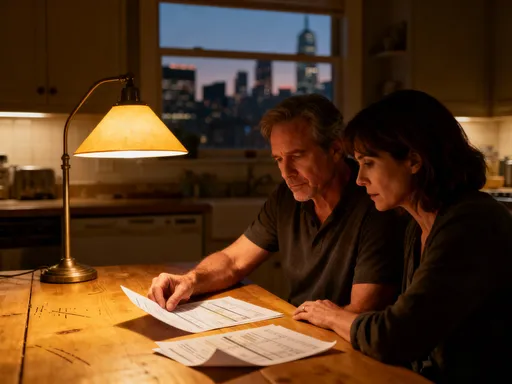

I also learned to filter out distractions. Financial media thrives on urgency—“Act now before the rally ends!” or “This stock could double!”—but most of it is irrelevant to long-term goals. I stopped checking my account daily and limited my financial reading to once a month. I subscribed to a few trusted sources and ignored the rest. I also talked openly with my spouse about our progress, which helped us stay united and patient. When we saw a market dip, we reminded each other that we were in it for the long haul. That shared perspective made all the difference.

Practical Steps to Stay on Track Without Losing Sleep

Today, our education fund is on solid ground—not because we picked winning stocks, but because we built a sustainable plan. Here are the steps that helped us get there. First, we opened a 529 college savings plan, which offers tax-free growth and withdrawals for qualified education expenses. These accounts are widely available, low-cost, and designed specifically for this goal. We chose a plan with age-based investment options, which automatically adjust the asset mix as our daughter gets older. At age 5, the portfolio is mostly stocks. By age 17, it will be mostly bonds and cash equivalents.

Second, we set up automatic monthly contributions. Even small amounts—$100 or $200—add up over time, especially with compounding. Automating the process removes emotion and ensures consistency. We also increased contributions whenever we got a raise or bonus, treating it like a non-negotiable expense. Third, we review the plan once a year. We check the balance, confirm the asset allocation is still appropriate, and make adjustments if needed—like shifting to a more conservative mix as we approach college. We don’t react to daily fluctuations or news headlines. We stick to the schedule.

Fourth, we keep costs low. We avoid high-fee funds and unnecessary insurance riders. We use low-cost index funds that track the overall market, which historically have delivered strong long-term returns. Fifth, we maintain flexibility. If our daughter receives scholarships, we can use the funds for graduate school or transfer them to another family member. The 529 plan isn’t rigid—it adapts to life changes. Finally, we focus on what we can control: saving regularly, staying diversified, and staying patient. We don’t worry about beating the market. We just want to meet our goal.

Looking back, I’m grateful for the mistakes I made. They taught me more than success ever could. I learned that smart investing isn’t about brilliance or luck. It’s about humility, discipline, and clarity. It’s about protecting what matters most by avoiding what seems exciting but is actually dangerous. For any parent reading this, know that you don’t have to be perfect. You just have to be consistent. Start where you are. Use simple tools. Stay the course. The future you’re building isn’t just financial—it’s emotional, too. It’s the peace of mind that comes from knowing you’ve done your best, not by chasing returns, but by building something steady, smart, and lasting.