When Life Throws a Curveball: My Real Talk on Staying Financially Ready

What happens when a sudden illness hits—how do you keep your finances from crashing too? I’ve been there, and it’s not just about medical bills. It’s the lost income, the stress, the domino effect on your future. This isn’t fear-mongering—it’s real talk. I’ll walk you through practical, tested strategies that helped me stay afloat. No jargon, no hype—just clear, actionable steps to protect your money when health goes sideways. The truth is, most of us believe we’re financially stable until something unexpected pulls the rug out. A diagnosis can change everything in an instant. And when that moment comes, your savings, insurance, and planning—or lack of them—will determine whether you weather the storm or get swept away. This is about building resilience before crisis strikes.

The Wake-Up Call: How One Illness Exposed My Financial Gaps

It started with fatigue—nothing alarming at first. But after weeks of worsening symptoms, a visit to the doctor led to a diagnosis that changed everything: an autoimmune condition requiring long-term treatment and months of recovery. At first, my focus was entirely on healing. But within weeks, the financial strain began to surface. Medical deductibles stacked up. Specialist visits weren’t fully covered. And because I couldn’t work full-time during flare-ups, my income dropped by nearly half. I had a budget, yes, and even some savings, but nothing prepared me for the compounding effect of ongoing expenses and reduced cash flow.

What shocked me most wasn’t the cost of care—it was the hidden financial toll. Transportation to appointments, prescription co-pays, and even home modifications for accessibility added unexpected layers of spending. I had always thought of myself as financially responsible. I paid my bills on time, avoided credit card debt, and contributed to retirement. But responsibility isn’t the same as resilience. Resilience means being ready for the unpredictable, not just managing the predictable. This experience forced me to confront a hard truth: feeling financially stable during calm times doesn’t mean you’re protected when life gets rough. The gap between appearance and reality was wider than I’d realized.

That period of uncertainty became a turning point. Instead of retreating into stress or denial, I decided to rebuild—not just my health, but my financial foundation. I began researching how others navigated similar challenges, spoke with financial advisors, and reviewed my own habits with brutal honesty. I realized that traditional budgeting, while essential, wasn’t enough on its own. It addressed monthly expenses but didn’t account for sudden income loss or high-cost medical scenarios. True financial security required a layered approach—one that included emergency planning, insurance literacy, and proactive debt management. This wasn’t about becoming an expert overnight, but about making small, consistent changes that added up to real protection.

Emergency Fund: Not Just a Safety Net—It’s Your First Line of Defense

An emergency fund is often described as three to six months of living expenses. While that rule of thumb is a good starting point, it doesn’t go far enough when health is involved. A true medical emergency fund must account for more than rent, groceries, and utilities. It should include medical deductibles, co-insurance, transportation costs, medication expenses, and—if applicable—caregiver support or home care services. For many, lost wages are the biggest financial hit. If you’re self-employed or work hourly, a few weeks off can mean thousands in missing income. That’s why your emergency fund should be built with worst-case scenarios in mind, not just minor disruptions.

Building this kind of reserve doesn’t require a high income—just consistency and intention. Start small. Even $25 a week adds up to over $1,300 in a year. Automate transfers to a separate, high-yield savings account so the money isn’t tempting to spend. Treat it like a non-negotiable bill, just like your mortgage or car payment. If your budget is tight, look for areas to trim temporarily—streaming subscriptions, dining out, or unused memberships. Redirect those savings into your emergency fund. The goal isn’t rapid accumulation, but steady progress. Over time, what feels like a drop in the bucket becomes a meaningful cushion.

Equally important is accessibility. Your emergency fund should be liquid—meaning you can access it quickly without penalties or delays. This is not the place for long-term investments, retirement accounts, or locked savings products. While those serve other purposes, they won’t help when you need cash now. A high-yield savings account offers modest interest while keeping your money available. Avoid dipping into this fund for non-emergencies. That discipline is what makes it effective. When a real crisis hits, you’ll be grateful you preserved it. Think of your emergency fund as the foundation of your financial house. Without it, everything else—insurance, investments, retirement planning—becomes far more vulnerable when life throws a curveball.

Insurance Decoded: Finding the Right Coverage Without Getting Played

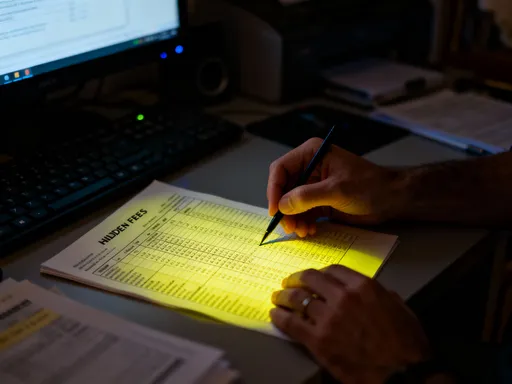

Health insurance is a given for most, but it’s only one piece of the puzzle. Many people assume their employer-provided plan covers them fully, only to discover gaps when they file a claim. High deductibles, out-of-network charges, and limited coverage for certain treatments can leave patients with surprise bills. That’s why understanding your policy—really understanding it—is crucial. Take the time to read the summary of benefits and coverage. Know your deductible, co-pay, and out-of-pocket maximum. Ask whether pre-authorization is required for procedures. These details matter, especially when time and energy are already stretched thin.

Beyond standard health insurance, two other types offer critical protection: disability insurance and critical illness insurance. Disability insurance replaces a portion of your income if you’re unable to work due to illness or injury. It’s one of the most overlooked yet valuable tools, particularly for those without a financial partner or substantial savings. Critical illness insurance, on the other hand, provides a lump-sum payment if you’re diagnosed with a covered condition like cancer, heart attack, or stroke. While not a substitute for disability coverage, it can help cover non-medical expenses like mortgage payments, travel for treatment, or home modifications.

When evaluating policies, focus on the fine print, not the sales pitch. Look for waiting periods—how long before benefits kick in—and what conditions are excluded. Some plans have narrow definitions of disability or require you to be completely unable to work in any job, not just your own. That can make qualifying difficult. For critical illness plans, check whether partial payments are offered for less severe cases. Premiums vary based on age, health, and coverage level, so compare options carefully. If your employer offers these benefits, review them thoroughly. If not, consider purchasing a policy independently. The goal isn’t to over-insure, but to close the most dangerous financial gaps. Insurance isn’t about betting against your health—it’s about protecting your livelihood so you can focus on healing.

Income Protection: What Happens When You Can’t Work?

One of the most underestimated risks during a health crisis is the loss of income. Medical bills are daunting, but without a paycheck, even basic living expenses become unmanageable. This is where disability insurance plays a vital role. Unlike workers’ compensation, which only covers job-related injuries, disability insurance applies to any qualifying illness or injury that prevents you from working. Short-term disability typically covers three to six months and often begins after a two-week waiting period. Long-term disability can extend for years, sometimes until retirement age, and usually kicks in after short-term benefits end.

For employees, these benefits may be offered through an employer, but coverage levels vary widely. Some plans replace only 40% to 60% of your salary, and benefits may be taxed if the employer paid the premiums. That means your take-home amount could be significantly less than expected. It’s important to calculate what you’d actually receive and whether it’s enough to cover essentials. If the coverage is insufficient, you may be able to purchase supplemental insurance. This additional layer can make the difference between barely surviving and maintaining some stability during recovery.

For freelancers, gig workers, or those without access to employer-sponsored plans, the challenge is greater—but not insurmountable. Individual disability policies are available through insurance providers and brokers. While premiums may be higher, the protection is often worth it. When shopping, consider your income variability and choose a policy that reflects your average earnings. Some plans allow you to adjust coverage as your income changes. Also, look for non-cancelable or guaranteed renewable terms, which protect you from rate hikes or policy cancellation as long as you pay premiums. The key is to act before you need it. Once you’re diagnosed with a health condition, your options shrink dramatically. Income protection isn’t a luxury—it’s a necessity for anyone who relies on their ability to work for financial security.

Smart Debt Management: Avoiding the Spiral During Medical Crises

Medical emergencies are one of the leading causes of debt in households, even for those with insurance. High deductibles, uncovered treatments, and extended recovery periods can force families to turn to credit cards, personal loans, or payment plans. While borrowing may seem like the only option, how you manage that debt can determine whether you recover financially—or spiral into long-term hardship. The first step is to avoid high-interest debt whenever possible. Credit cards with 20%+ interest rates can turn a $5,000 medical bill into $7,000 or more over time. Payday loans and cash advances are even more dangerous, often trapping borrowers in cycles of repayment.

Instead, explore alternatives early. Many hospitals and providers offer financial assistance programs or sliding-scale fees based on income. Don’t hesitate to ask. You can also negotiate bills directly—sometimes a provider will reduce charges or offer a discount for prompt payment. If you need time, request an interest-free payment plan. Most institutions would rather receive partial payments over time than risk non-payment. Put these agreements in writing to avoid misunderstandings later. If you already have medical debt, prioritize it based on interest rate and urgency. Focus on accounts that report to credit bureaus or are close to collections.

Communication is key. If you’re struggling to make payments, contact creditors before missing a due date. Many are willing to work with you, especially if you show a willingness to pay. Some may offer temporary forbearance or reduced payments. The goal is to avoid default, which damages credit and limits future financial options. Above all, resist the temptation to withdraw from retirement accounts like a 401(k) or IRA. While it may solve an immediate problem, early withdrawals trigger taxes and penalties, and you lose years of compounded growth. That trade-off can cost you tens of thousands down the line. Debt is manageable with the right approach—panic and inaction are what turn temporary setbacks into lasting damage.

The Power of a Financial Contingency Plan

When you’re unwell, decision-making becomes harder. Stress, medication, and fatigue can cloud judgment at the very moment when smart financial choices matter most. That’s why having a contingency plan in place before a crisis is so powerful. A financial contingency plan is a personalized roadmap that outlines exactly what to do if you become unable to manage your finances. It answers questions like: Who will pay the bills? Where are important documents stored? Which accounts need immediate access? Having these answers ready reduces stress and prevents costly delays.

Start by organizing key documents in one secure location—physical or digital. Include insurance policies, bank and investment account details, wills, powers of attorney, and contact information for advisors. Make sure a trusted family member or friend knows where to find them. Next, consider setting up joint access or authorized user status on critical accounts. This allows someone you trust to manage payments and communications without legal hurdles. A durable power of attorney for finances is another essential tool. It legally designates someone to act on your behalf if you’re incapacitated. Without it, loved ones may need to go through court to gain authority, a process that’s time-consuming and expensive.

Finally, create a step-by-step action list. Include immediate steps—like contacting your insurer and employer—and longer-term actions, such as reviewing budget adjustments or applying for disability benefits. List deadlines, required forms, and key contacts. Keep this plan updated and review it annually. The goal isn’t to anticipate every possible scenario, but to remove guesswork when you’re least able to handle it. A contingency plan isn’t just practical—it’s an act of care for yourself and your family. It ensures that when health falters, your financial well-being doesn’t have to.

Building Resilience: Small Habits That Add Up Over Time

Financial resilience isn’t built in a day. It’s the result of consistent, thoughtful habits practiced over time. The most effective strategies aren’t dramatic—they’re sustainable. Regular financial check-ins, even just 30 minutes a month, help you stay aware of your cash flow, debt levels, and savings progress. Use this time to adjust budgets, review insurance coverage, and track emergency fund growth. These small moments of attention prevent small issues from becoming big problems.

Micro-savings is another powerful habit. Set up automatic transfers of $10 or $20 to your emergency fund with each paycheck. It’s easy to overlook, but over a year, that’s $260 to $520—enough to cover a car repair or an unexpected medical co-pay. Pair this with periodic reviews of your insurance policies. Life changes—marriage, children, career shifts—can affect your risk profile. What made sense five years ago may no longer be adequate. Reassessing coverage annually ensures you’re neither under-protected nor overpaying for unnecessary benefits.

Ultimately, financial preparedness is part of overall wellness. Just as we exercise to maintain physical health, we must practice financial hygiene to maintain stability. Viewing risk planning as empowerment—not fear—shifts the mindset from anxiety to action. You’re not preparing for disaster; you’re creating space to recover with dignity. The goal isn’t perfection, but progress. Because when life throws a curveball, the best comfort isn’t just knowing you’ll survive—it’s knowing you’ve done everything possible to protect your future.