What It Really Costs to Retire Early — And How to Make It Work

So you’ve dreamed about leaving the 9-to-5 grind behind and retiring early? I did too — but what I didn’t realize was how much hidden cost lurks beneath that freedom. It’s not just about saving a big number. Healthcare, inflation, lifestyle creep — they all add up faster than you think. I tested this in real life, made mistakes, and learned what actually matters when analyzing early retirement costs. Let me walk you through the real math, the overlooked risks, and the smart moves that make it sustainable. This isn’t about wishful thinking or chasing viral online trends. It’s about grounding your vision in numbers, planning for decades of uncertainty, and building a strategy that holds up when markets dip, medical bills rise, or life simply changes course.

The Allure and Reality of Early Retirement

Early retirement captures the imagination like few other financial goals. The idea of trading office meetings for morning hikes, work emails for travel itineraries, or overtime for time with family is undeniably powerful. For many, especially those in high-stress jobs or long commutes, the dream isn’t just about leisure — it’s about reclaiming autonomy. Yet beneath the surface of this appealing vision lies a complex financial reality that few fully grasp before taking the leap. Early retirement isn’t a vacation. It’s a lifelong financial commitment to fund decades without a paycheck, often beginning in your 40s or 50s, and stretching 30, 40, or even 50 years into the future.

The emotional appeal is strong, and rightfully so. After years of budgeting, saving, and delaying gratification, the promise of freedom can feel like the ultimate reward. But unlike traditional retirement, which typically begins around age 65 when Social Security and pension benefits kick in, early retirement requires entirely self-funded living. That means no government-backed income support for a significant portion of your retired life. The burden falls entirely on personal savings, investment returns, and careful planning. Without a steady income stream, even minor miscalculations in budgeting or unexpected expenses can snowball over time, threatening long-term sustainability.

Another overlooked factor is the psychological shift. Many assume that retiring early means doing less — less work, less responsibility, less stress. But the transition often brings its own challenges. Without the structure of a job, some struggle with purpose or daily routine. Others find that their spending increases because they have more time to spend money — on travel, dining out, hobbies, or home projects. This phenomenon, known as lifestyle creep, can quietly inflate annual expenses and erode savings faster than anticipated. The key is to recognize that early retirement isn’t an escape from responsibility, but a shift in how you manage time, money, and goals.

Success in early retirement depends less on how much you save and more on how well you plan for the long haul. It requires discipline, flexibility, and a clear-eyed view of both current and future costs. The dream is valid, but it must be built on a foundation of realistic expectations and sound financial principles. Those who succeed don’t just retire early — they plan early, adjust often, and stay vigilant about the risks that come with living off savings for decades.

Mapping Out Your True Annual Cost of Living

One of the most common mistakes in early retirement planning is underestimating actual living expenses. Many people base their retirement budget on current spending, but fail to account for how lifestyle changes can alter that number. The truth is, your cost of living in retirement may not decrease — it could even increase. To build a sustainable plan, you must go beyond surface-level estimates and map out a detailed, realistic annual budget that reflects your true needs and aspirations.

Start by tracking your current spending for at least six months. Categorize every expense: housing, groceries, transportation, insurance, entertainment, travel, subscriptions, and discretionary spending. Look for patterns. Are you dining out more on weekends? Do you have recurring annual costs like property taxes or medical deductibles? Once you have a clear picture of today’s spending, consider how retirement will change these habits. Will you travel more? Will your commute disappear but be replaced by car trips for leisure? Will you take up new hobbies that require equipment or memberships?

Next, adjust for inflation. Even a modest 2.5% annual inflation rate can double your expenses in about 30 years. If you plan to retire at 50 and live until 90, that’s four decades of rising prices to account for. A $50,000 annual budget today could require $130,000 per year by your 70s to maintain the same purchasing power. This isn’t speculation — it’s basic compounding math. Failing to factor in inflation is one of the most dangerous oversights in retirement planning.

Also, consider one-time or irregular expenses. Home repairs, appliance replacements, major medical procedures, or family events like weddings can create significant cash flow disruptions. A solid retirement plan includes a buffer for these costs, either through an emergency fund or a separate reserve account. Without it, you may be forced to sell investments at a loss during market downturns, jeopardizing long-term portfolio health. The goal is to create a budget that’s not just accurate, but resilient — one that can absorb surprises without derailing your financial trajectory.

Finally, distinguish between essential and discretionary spending. Essentials — housing, food, healthcare, utilities — are non-negotiable. Discretionary costs, like travel or entertainment, offer flexibility. Understanding this difference allows you to build a tiered spending plan, where you can scale back during tough years without sacrificing basic needs. This level of detail transforms your retirement budget from a hopeful guess into a reliable financial roadmap.

The Long-Term Impact of Inflation and Healthcare

Inflation and healthcare are two of the most underestimated threats to early retirement. While market volatility grabs headlines, these quiet forces erode purchasing power and drain savings over time, often without immediate notice. Together, they form a powerful combination that can undermine even the most carefully constructed financial plans if not properly addressed.

Inflation, the gradual rise in prices, affects everything from groceries to property taxes. Over a 30- or 40-year retirement, its impact is profound. A 3% annual inflation rate — well within historical averages — means prices double every 24 years. That $3 loaf of bread today could cost $6 in two decades. For retirees relying on a fixed withdrawal rate, this means each dollar buys less over time. The danger isn’t just higher prices — it’s the compounding effect on all expenses. Housing, utilities, transportation, and especially healthcare all rise with inflation, squeezing budgets year after year.

To protect against inflation, your investment portfolio must include assets that historically outpace rising prices. Stocks, real estate, and Treasury Inflation-Protected Securities (TIPS) have shown long-term resilience. Relying solely on bonds or cash may feel safer, but it exposes you to the risk of losing ground to inflation. A balanced, growth-oriented portfolio is essential to preserve purchasing power over decades. Additionally, consider structuring withdrawals to increase slightly each year to match inflation, rather than sticking to a fixed dollar amount.

Healthcare is often the largest and most unpredictable expense in early retirement. Unlike those who retire at 65 and qualify for Medicare, early retirees must secure private insurance, which can be costly and complex. Premiums, deductibles, co-pays, and prescription costs add up quickly. A single major health event can result in tens of thousands of dollars in out-of-pocket expenses, even with insurance. According to data from Fidelity, a 65-year-old couple retiring today can expect to spend nearly $300,000 on healthcare over retirement — and that doesn’t include long-term care. For someone retiring at 50, those costs could easily exceed $500,000 when adjusted for inflation and additional years without Medicare.

Planning for healthcare requires proactive strategy. Health Savings Accounts (HSAs) are one of the most powerful tools available. Contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. If you’re still working, maximize HSA contributions before retiring. These funds can be used decades later to cover medical costs, effectively creating a tax-advantaged healthcare nest egg. Additionally, consider the cost of insurance options like COBRA, ACA marketplace plans, or private policies, and factor premiums into your annual budget.

Long-term care is another critical consideration. The odds of needing assisted living, home health aides, or nursing home care increase with age. Traditional health insurance and Medicare do not cover most long-term care expenses. While long-term care insurance is expensive and often has strict eligibility rules, it may be worth evaluating for those with significant assets. Alternatively, some build a dedicated savings pool to self-insure against this risk. Regardless of the approach, ignoring long-term care costs is not an option in early retirement planning.

Withdrawal Rates and Portfolio Sustainability

One of the most debated topics in retirement planning is how much you can safely withdraw from your savings each year. The so-called “4% rule” has long been a benchmark: withdraw 4% of your portfolio in the first year of retirement, then adjust that amount annually for inflation. For example, a $1 million portfolio would generate $40,000 in the first year. But is this rule still reliable for early retirees facing longer time horizons and greater market uncertainty?

The 4% rule was based on historical market data from the 20th century, assuming a 30-year retirement. For someone retiring at 65, that may still be a reasonable starting point. But for someone retiring at 50 with a potential 40- or 50-year horizon, the risk of running out of money increases significantly. The main threat isn’t just poor long-term returns — it’s sequence-of-returns risk. This refers to the danger of experiencing market downturns in the early years of retirement, when withdrawals are reducing the portfolio just as its value is declining. This double hit can permanently impair portfolio longevity.

For example, imagine retiring in 2008 with a $1 million portfolio and following the 4% rule. The financial crisis causes a 30% market drop. Even as you withdraw $40,000, your portfolio falls to $660,000. Recovering from that low base takes years, and the withdrawals during the downturn reduce the amount available to benefit from the eventual rebound. Studies show that early retirees who experience such scenarios may need to reduce their withdrawal rate to 3% or even 2.5% to avoid depletion.

A more flexible approach is often wiser. Instead of rigidly increasing withdrawals for inflation every year, consider adjusting based on market performance. In down years, reduce discretionary spending and withdraw less. In strong years, you can afford to spend a bit more. This dynamic withdrawal strategy helps preserve capital during volatility and extends portfolio life. Another option is to maintain a cash buffer — one to three years of living expenses — in a high-yield savings account. This allows you to withdraw from cash during market dips, avoiding the need to sell investments at a loss.

Asset allocation also plays a crucial role. A portfolio too heavily weighted in stocks increases volatility, while one too conservative in bonds may not grow enough to keep pace with inflation. A balanced mix — such as 50% to 70% in equities, depending on risk tolerance and time horizon — offers growth potential with some stability. Rebalancing annually helps maintain target allocations and enforces a disciplined “buy low, sell high” approach.

The key takeaway is that there’s no one-size-fits-all withdrawal rate. Your safe withdrawal rate depends on your portfolio size, expected returns, spending flexibility, and tolerance for risk. Regularly reviewing and adjusting your strategy based on actual performance and life changes is essential for long-term sustainability.

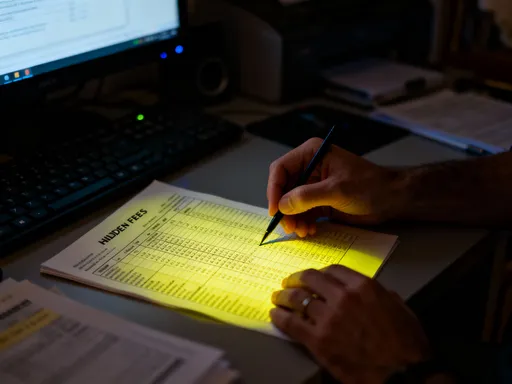

Tax Efficiency: The Hidden Lever in Retirement Planning

Taxes are one of the largest expenses most retirees will face — and one of the most controllable. Unlike market returns, which are unpredictable, tax strategy is within your influence. Smart tax planning can preserve tens or even hundreds of thousands of dollars over a 30- or 40-year retirement. Yet many overlook this critical component, focusing only on investment returns while allowing taxes to quietly erode their savings.

The foundation of tax efficiency lies in understanding the different types of retirement accounts and how they are taxed. Traditional IRAs and 401(k)s offer tax-deferred growth — contributions are made with pre-tax dollars, and taxes are paid upon withdrawal. Roth IRAs and Roth 401(k)s, on the other hand, are funded with after-tax dollars, but qualified withdrawals are tax-free. Each has its place in a retirement strategy. The goal is to create a “tax diversification” strategy that gives you control over your taxable income in retirement.

For example, by having both traditional and Roth accounts, you can manage your annual withdrawals to stay within a lower tax bracket. In years when you need more income, you might pull from Roth accounts to avoid pushing yourself into a higher bracket. In years with lower spending, you could withdraw from traditional accounts and use the extra income to do a Roth conversion — paying taxes now at a lower rate to convert pre-tax money into tax-free Roth funds. This strategy, known as “tax bracket arbitrage,” can significantly reduce lifetime tax liability.

Another key consideration is Required Minimum Distributions (RMDs). Starting at age 73 (as of 2023), owners of traditional IRAs and 401(k)s must begin taking annual withdrawals, whether they need the money or not. These withdrawals are taxed as ordinary income and can push you into higher tax brackets, increasing Medicare premiums and reducing tax credits. Early retirees can plan ahead by gradually withdrawing from traditional accounts before RMDs begin, smoothing out tax liability over time.

Tax-loss harvesting is another valuable tool. When investments decline in value, selling them at a loss can offset capital gains taxes. While you can’t deduct unlimited losses in a single year, unused losses can be carried forward indefinitely. This strategy is particularly useful in taxable brokerage accounts, where capital gains are realized upon sale. When combined with careful asset location — placing tax-inefficient investments like bonds in tax-advantaged accounts and tax-efficient ones like index funds in taxable accounts — the savings add up over time.

Finally, consider geographic tax planning. State income taxes vary widely. Some states have no income tax, while others tax retirement income heavily. Relocating to a more tax-friendly state before or during retirement can reduce your annual tax burden. Property taxes, sales taxes, and estate taxes should also be factored in. A holistic view of tax exposure helps you make informed decisions that protect more of your hard-earned wealth.

Risk Management Beyond the Stock Market

When most people think of retirement risk, they focus on the stock market — the fear of a crash wiping out their portfolio. But financial risk extends far beyond market volatility. Job loss during the accumulation phase, unexpected health issues, disability, long-term care needs, and even geographic cost shocks can derail even the most disciplined savers. A truly resilient retirement plan prepares for these less visible but equally dangerous threats.

One of the first lines of defense is an emergency fund. Most financial experts recommend three to six months of living expenses in a liquid, accessible account. For early retirees, this buffer is even more critical. Without a paycheck, unexpected costs — like a major car repair or urgent home maintenance — can force premature withdrawals from investments. A dedicated emergency fund allows you to handle these surprises without disrupting your long-term strategy.

Insurance plays a vital role in risk management. Health insurance, as discussed, is essential for early retirees. But other forms of coverage are equally important. Disability insurance protects your income during the working years, ensuring that an injury or illness doesn’t destroy your ability to save. Life insurance may be necessary if you have dependents or outstanding debts. Long-term care insurance, while expensive, can prevent a single health event from depleting your savings. Evaluating these policies during the accumulation phase — when you’re younger and healthier — often results in lower premiums and better coverage.

Income diversification is another key strategy. Relying solely on investment withdrawals creates pressure on your portfolio. Even a modest side income — from part-time consulting, rental properties, or a small business — can reduce the amount you need to withdraw annually. This not only extends portfolio life but also provides a sense of purpose and engagement. Many early retirees find that working part-time, even in a low-stress role, improves their quality of life while easing financial strain.

Inflation risk, sequence-of-returns risk, and longevity risk — the chance of outliving your money — must also be addressed. Longevity risk is particularly relevant for early retirees, who may live for decades without a paycheck. Planning for a 90- or 100-year lifespan, rather than assuming retirement ends at 85, builds in a margin of safety. This doesn’t mean living frugally — it means building a plan robust enough to handle the unexpected.

The goal is not to eliminate all risk — that’s impossible — but to manage it wisely. A resilient retirement plan includes multiple layers of protection: savings, insurance, diversified income, and flexible spending. By anticipating potential setbacks and preparing for them in advance, you increase your odds of long-term success and peace of mind.

Building a Flexible, Realistic Retirement Plan

No retirement plan survives contact with reality unchanged. Life is unpredictable. Markets fluctuate. Health changes. Personal priorities evolve. The most successful early retirees aren’t those with perfect plans — they’re the ones who build flexibility into their strategy and adapt when circumstances shift. Rigidity leads to failure; adaptability leads to sustainability.

A flexible retirement plan starts with monitoring key metrics. Create a “retirement dashboard” that tracks your portfolio value, annual spending, withdrawal rate, inflation adjustments, tax brackets, and emergency fund balance. Review this dashboard quarterly or annually to assess whether you’re on track. If the market has a strong year, you may have room to increase discretionary spending. If it’s a down year, you can temporarily reduce non-essential expenses to protect your portfolio.

Spending flexibility is crucial. Instead of locking in a fixed budget, design a tiered system: essential, discretionary, and aspirational spending. Essentials cover housing, food, healthcare, and utilities. Discretionary includes travel, dining, and hobbies. Aspirational might be a dream vacation or home renovation. In tough years, you can pause aspirational spending and scale back discretionary costs without sacrificing basic needs. This approach gives you control and reduces stress during market downturns.

Another form of flexibility is the willingness to re-enter the workforce, even temporarily. Many early retirees find that after a few years of full freedom, they miss the structure, social connection, or sense of purpose that work provides. Taking on part-time work, consulting, or seasonal jobs can supplement income, reduce withdrawal pressure, and extend portfolio life. It doesn’t mean failing — it means being smart and responsive to changing conditions.

Geographic flexibility can also be a powerful tool. If living costs rise in your current area, consider relocating to a lower-cost region or country. Some early retirees downsize their home, move to a state with no income tax, or even explore affordable international destinations with good healthcare and infrastructure. Relocation isn’t for everyone, but it’s an option worth considering as part of a dynamic plan.

Finally, embrace the idea that retirement is not a static destination, but a journey. Your goals at 50 may differ from those at 65. What matters most is not sticking to an original plan at all costs, but adjusting it to maintain financial health and personal fulfillment. The ultimate goal of early retirement isn’t just financial independence — it’s peace of mind, freedom, and the ability to live life on your own terms, no matter what the future holds.