How I Turned Luxury Buys into Smart Investments — And What It Revealed About Today’s Market

I used to see luxury purchases as just splurges—until I realized they could actually align with market trends and personal value. Over time, I started spotting patterns: certain brands held value, some items even appreciated, and a few opened doors to unexpected opportunities. It wasn’t about showing off anymore; it was about making thoughtful moves. This shift changed how I view spending, investing, and opportunity in today’s evolving economy. What began as a personal curiosity grew into a broader understanding of how value is preserved, transferred, and sometimes even multiplied through seemingly ordinary consumer choices. The line between consumption and investment isn’t always clear—but it’s becoming more relevant for everyday decision-making.

The Moment I Saw a Handbag Differently

It wasn’t a financial advisor or a market report that changed my thinking—it was a quiet conversation over coffee with a friend who casually mentioned she had sold her designer handbag for exactly what she paid years earlier. At first, I assumed she was exaggerating. After all, most things lose value the moment they leave the store. Cars depreciate. Electronics become outdated. Clothing wears out. But this bag—not only had it maintained its worth, it had become more desirable. That moment planted a seed. I began to wonder: could certain luxury goods behave more like assets than expenses?

Curiosity led me to research resale platforms, brand histories, and consumer behavior in high-end markets. I discovered that some handbags from select fashion houses had, over the past decade, consistently increased in value—sometimes outpacing inflation or even modest stock market gains. These weren’t random items; they were specific models known for craftsmanship, limited availability, and strong brand loyalty. The Hermès Birkin and Kelly bags, for example, have long been cited in financial circles for their ability to retain and grow value, often requiring years of client history before even being offered for purchase. This wasn’t just fashion—it was a system of controlled supply meeting persistent demand.

What struck me most was how few people treated these items as anything more than status symbols. Yet, behind the scenes, a parallel market was thriving—one where condition, provenance, and timing mattered as much as they do in art or classic cars. I started to see that luxury, when approached with intention, could serve dual purposes: personal enjoyment and long-term value retention. This wasn’t about turning every purchase into an investment, but about recognizing that some choices carry lasting weight. The realization didn’t make me stop buying luxuries—it made me buy them differently.

Why Some Luxuries Hold Value (And Others Don’t)

Not all luxury items are built to last in the marketplace, even if they’re expensive. The key differentiator lies in three core factors: scarcity, brand equity, and enduring design. Items that maintain or increase in value typically come from brands that exercise tight control over production. Limited annual output, long waitlists, and invitation-only purchasing models create artificial scarcity, which in turn fuels demand. When supply is constrained and demand remains steady—or grows—the economic principle of value preservation kicks in.

Brand perception plays an equally important role. A luxury label with deep heritage, consistent craftsmanship, and cultural relevance is more likely to inspire long-term consumer trust. Think of brands like Rolex, Patek Philippe, or Chanel—names that have maintained prestige across generations. Their products are not just sold; they are inherited, collected, and sought after. This emotional and cultural capital translates into market resilience. Even during economic downturns, these brands often see slower depreciation or quicker recovery in resale prices compared to trend-driven labels.

Design longevity is another critical factor. Timeless silhouettes, neutral color palettes, and functional utility increase the likelihood that an item will remain desirable years later. A classic trench coat, a well-made leather tote, or a simple gold watch transcends seasonal trends. In contrast, items with bold logos, exaggerated shapes, or short-lived novelty appeal often lose relevance quickly. The resale market reflects this: while a limited-edition sneaker might fetch high prices at launch, it can plummet in value once the hype fades. Understanding these dynamics helps separate fleeting fashion from lasting value.

It’s also worth noting that certification and traceability are becoming more important. With the rise of counterfeits, buyers increasingly demand proof of authenticity—original receipts, serial numbers, service records. This documentation adds to an item’s credibility and, by extension, its resale potential. In essence, the most valuable luxuries are not just beautiful or expensive—they are verifiable, rare, and rooted in a legacy of quality.

From Consumer to Strategist: Changing the Mindset

My shopping habits used to be driven by emotion—celebrating a milestone, treating myself after a hard week, or simply falling in love with a design. There’s nothing wrong with that. But I began to notice a pattern: the items I felt most attached to weren’t always the ones I used most, and the ones I used most weren’t always the ones that kept their value. That disconnect prompted a shift in how I approached spending. Instead of asking, Do I want this?, I started asking, Will I still value this in three years? That simple question changed everything.

This mental reframe turned me from a passive consumer into an active strategist. I began evaluating purchases not just for their immediate appeal but for their long-term relevance. Would this piece still feel appropriate in different stages of life? Could it be worn in multiple settings—work, travel, casual outings? Did it align with my personal style, or was I chasing a trend? These questions didn’t eliminate indulgence, but they grounded it in intentionality. I still allowed myself to buy things purely for joy, but I became more deliberate about which items I expected to last—both in use and in value.

This mindset also helped me distinguish between luxury and excess. Owning fewer, higher-quality pieces reduced clutter and increased satisfaction. A single well-chosen coat could replace three cheaper alternatives. A durable handbag could serve for a decade or more. Over time, this approach saved money, reduced decision fatigue, and aligned my spending with my values. It wasn’t about denying pleasure—it was about enhancing it through mindfulness. The result was a wardrobe and lifestyle built on quality, not quantity, and a growing awareness that thoughtful consumption can coexist with financial prudence.

The Hidden Market: Resale, Authentication, and Timing

One of the most eye-opening discoveries was the sophistication of the luxury resale market. What was once a niche corner of secondhand shopping has evolved into a transparent, data-rich ecosystem. Platforms like The RealReal, Vestiaire Collective, and Chrono24 offer detailed pricing histories, condition assessments, and authentication services. These tools allow buyers and sellers to make informed decisions based on real market signals, not guesswork.

I tested this firsthand by selling a pre-owned luxury watch I had worn occasionally. I was surprised by how streamlined the process was. The platform provided a prepaid shipping label, conducted a thorough inspection, and listed the item with professional photos and a detailed description. Within weeks, it sold for 85% of its original retail price—a figure that reflected its condition, model popularity, and current market demand. The experience taught me that resale value isn’t fixed; it’s influenced by timing, care, and market sentiment.

Authentication emerged as a critical factor. Buyers are cautious, and for good reason—counterfeit goods remain a significant issue in the luxury space. Reputable resale platforms employ expert verifiers who examine stitching, hardware, serial numbers, and even microscopic details. Some brands, like Louis Vuitton and Gucci, have taken steps to enhance traceability through digital certificates or blockchain-based ownership records. These innovations increase trust and make it easier to prove an item’s journey from purchase to resale.

Timing also plays a strategic role. Just as in financial markets, entering and exiting at the right moment can make a difference. A handbag released during a brand’s peak popularity may command higher prices in the first few years. Conversely, a model that has been discontinued or reissued in a new version might see a surge in collector interest. Monitoring these trends doesn’t require constant vigilance, but a basic awareness can help optimize returns. The resale market, in this sense, acts as a feedback loop—revealing which items have staying power and which are best enjoyed in the moment.

Balancing Passion and Practicality

Let’s be honest: not every luxury purchase should be judged by its resale value. Some items are bought for the joy they bring in the present—the thrill of a new dress for a special occasion, the comfort of a favorite pair of shoes, or the sentimental value of a gift. Trying to assign financial metrics to every emotional experience would drain the pleasure out of life. The goal isn’t to eliminate indulgence, but to balance it with awareness.

To manage this, I developed a simple mental framework: I now categorize luxury purchases into two buckets—pure enjoyment and value-conscious luxury. The first includes items I buy solely for personal delight, knowing they may not hold value. These are often trend-driven, highly personal, or used in ways that affect condition. The second category includes pieces I choose for their durability, timeless appeal, and potential to retain worth. These are the items I care for meticulously and consider reselling down the line.

This distinction has reduced buyer’s remorse and increased overall satisfaction. When I spend on something in the pure enjoyment category, I do so without guilt, because I’ve already accepted it as a cost of living well. When I invest in a value-conscious piece, I feel confident that even if I eventually part with it, I’m unlikely to lose significantly. This approach doesn’t restrict spending—it makes it more intentional. It allows for both spontaneity and strategy, ensuring that financial responsibility doesn’t come at the expense of personal fulfillment.

Risks You Can’t Ignore

It’s important to acknowledge that treating luxury items as semi-investments comes with real risks. First, market tastes are unpredictable. A designer or style that feels essential today may fall out of favor tomorrow. I learned this the hard way when a niche European brand I admired lost momentum after a change in creative direction. The pieces I owned, once considered exclusive, became harder to sell, and their value dipped. No amount of craftsmanship can fully insulate an item from shifting cultural currents.

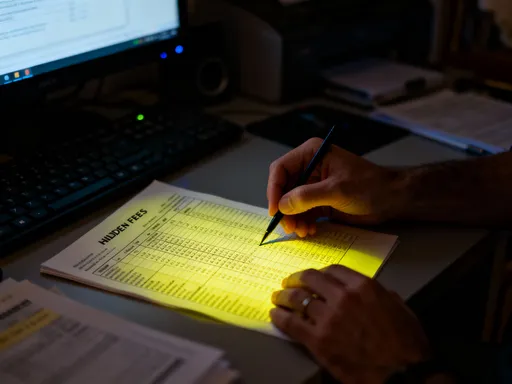

Second, ownership costs are often overlooked. Luxury goods may require special storage—climate-controlled spaces for leather, protective cases for jewelry, or professional cleaning services. Insurance is another consideration. Standard homeowner’s policies may not cover high-value items, requiring additional riders that add to the overall cost. Authentication fees, platform commissions, and shipping expenses also eat into potential profits. These hidden costs can reduce net returns, sometimes significantly.

Liquidity is another concern. Unlike stocks or bonds, luxury items aren’t instantly tradable. Selling can take time, especially if you’re waiting for the right buyer or optimal market conditions. A sudden need for cash might force a sale at a lower price. Additionally, the resale market is sensitive to economic cycles. During recessions, discretionary spending declines, and demand for high-end goods often softens. These factors mean that luxury assets should never be relied upon as primary sources of emergency funds or guaranteed returns.

Finally, emotional attachment can cloud judgment. It’s easy to overestimate an item’s value because of personal significance. A watch given as a gift, a dress worn on a memorable trip—these carry meaning beyond price tags. Letting go can be difficult, and pricing them objectively requires discipline. Recognizing these limitations helps maintain realistic expectations and prevents overcommitment.

What This Means for Broader Market Opportunities

The evolving relationship between consumers and luxury goods reflects larger economic and cultural shifts. People are no longer passive buyers; they are active participants in value creation, preservation, and transfer. The rise of resale platforms, digital authentication, and rental services signals a move toward more circular consumption models—where ownership is not always permanent, and access can be as valuable as possession.

Brands are responding. Some, like Burberry and Prada, have partnered with resale platforms to authenticate and promote pre-owned items. Others are experimenting with blockchain technology to create digital passports for products, tracking ownership and service history. These innovations enhance transparency and trust, making it easier for consumers to buy, sell, and verify goods with confidence. They also open new investment opportunities—not necessarily in the items themselves, but in the infrastructure supporting them.

Consider the growth of companies specializing in authentication services, luxury storage solutions, or digital marketplaces. These sectors are benefiting from increased consumer interest in secondary markets. Similarly, financial institutions are beginning to recognize luxury assets as collateral for loans, a practice already common in high-net-worth circles. While not yet mainstream, this trend suggests that tangible luxury goods may play a larger role in personal finance strategies in the future.

For everyday consumers, the lesson is not to treat every purchase as a stock pick, but to recognize that value is multifaceted. It can be emotional, functional, and financial. By paying attention to how people assign worth, care for possessions, and navigate ownership, we gain insights into broader market behaviors. These patterns can inform smarter decisions—not just about what to buy, but how to think about value in an increasingly dynamic economy.

The real win isn’t resale value. It’s clarity. The process of evaluating luxury purchases through a more strategic lens has sharpened my financial awareness, deepened my appreciation for quality, and helped me align spending with long-term goals. It hasn’t made me richer in the traditional sense, but it has made me more confident in my choices. In a world where consumption is constant and choices are overwhelming, that kind of clarity is perhaps the most valuable asset of all.