When Disaster Hits, Is Your Money Ready?

Natural disasters strike without warning—floods, hurricanes, wildfires. When they do, your safety comes first, but what about your finances? I’ve seen families lose everything, not just homes but financial stability, simply because they weren’t prepared. It’s not just about insurance or savings; it’s about having a clear, actionable plan. In this article, I’ll walk you through how to protect your wealth before disaster hits, how to respond smartly when it does, and how to rebuild with confidence—without falling into common financial traps. The difference between recovery and ruin often comes down to preparation, clarity, and calm decision-making long before the storm arrives.

The Hidden Financial Cost of Natural Disasters

Natural disasters bring more than physical destruction; they trigger a chain reaction of financial consequences that can last for years. While images of flooded homes or scorched neighborhoods dominate the news, the deeper, quieter damage often lies in bank statements, credit reports, and household budgets. Families may survive the initial event only to face months of income loss, unexpected expenses, and mounting debt. A single hurricane can disrupt local economies, shutter small businesses, and lead to job layoffs. Wildfires may force temporary or permanent relocation, increasing living costs far from home. Even when property damage is covered, the indirect financial toll is rarely accounted for in standard planning.

Consider the family in a coastal town hit by a Category 3 hurricane. Their home sustained moderate wind damage, but floodwaters spared the foundation. They had homeowner’s insurance, so they assumed recovery would be manageable. What they didn’t anticipate was the three-month closure of the local factory where both parents worked. With no income and rising costs for temporary housing, meals, and transportation, their emergency fund evaporated within weeks. They began relying on credit cards to cover basic needs, eventually accruing thousands in high-interest debt. This scenario is not rare. According to data from the Federal Reserve, nearly 40% of American households would struggle to cover a $400 emergency expense. When a disaster amplifies that challenge, the strain becomes overwhelming.

The concept of financial resilience is critical here. It refers to a household’s ability to absorb a major shock without derailing long-term financial goals. Resilience isn’t just about having money saved; it’s about how accessible that money is, how diversified your income sources are, and how quickly you can adapt. Many people assume that insurance or a modest savings account is enough. But in reality, true preparedness requires a holistic view of risk. It means asking not only “What will my insurance cover?” but also “What happens if I can’t work for weeks?” or “How will I pay rent if I have to move suddenly?” These questions reveal gaps that traditional financial planning often overlooks.

Another hidden cost is the psychological toll on decision-making. Under stress, people are more likely to make impulsive financial choices—hiring the first contractor who shows up, overpaying for temporary lodging, or accepting unfavorable loan terms. These decisions, made in moments of urgency, can compound the financial damage long after the disaster has passed. The key is to reduce the number of decisions you must make in crisis by planning them in advance. That means knowing where your documents are, how much cash you have on hand, and who to contact for help. When chaos strikes, clarity is your most valuable asset.

Building Your Financial Safety Net Before Disaster Strikes

Preparation is the most effective form of financial protection. Just as a well-built house can withstand high winds, a well-structured financial plan can endure economic shocks. The foundation of this plan is the emergency fund—a dedicated pool of savings set aside specifically for unexpected events. Financial experts commonly recommend saving three to six months’ worth of living expenses. For families in disaster-prone areas, aiming for six to twelve months may be more appropriate. This fund should be kept in a liquid, easily accessible account, such as a high-yield savings account at a national bank, not one tied to a local branch that might close during a crisis.

Liquidity is essential. In the aftermath of a disaster, ATMs may be down, credit card systems may fail, and banks may be inaccessible. Cash becomes critical for immediate needs: food, fuel, medication, and small repairs. A practical step is to maintain a “disaster wallet” with $200 to $500 in small bills, stored in a waterproof container at home. This amount isn’t meant to cover all expenses, but to provide breathing room during the first 72 hours when services are disrupted. Equally important is ensuring that multiple family members know where this cash is kept and how to access it.

Beyond cash, digital access to financial information is vital. Paper documents like insurance policies, property deeds, bank account details, and identification can be lost or destroyed in fires or floods. To protect against this, create scanned copies of all critical documents and store them securely in the cloud using encrypted services. Share access with a trusted family member or advisor who lives outside your immediate area. This geographic independence ensures that even if your home is damaged, your financial records remain intact. Consider using a password manager with multi-factor authentication to organize login details for banks, insurance providers, and utility accounts.

Another often-overlooked element is the diversification of financial institutions. If all your accounts are with a single local bank, a regional outage could freeze your access to all funds. Spreading accounts across different institutions, especially those with national or online presence, increases redundancy. For example, keeping a portion of savings in an online bank with no physical branches ensures access even if local infrastructure is compromised. Similarly, having a backup credit card from a different issuer can be a lifeline when one network is down. These steps may seem minor, but in a crisis, they can make the difference between resilience and dependency.

Insurance: What It Covers—and Where It Falls Short

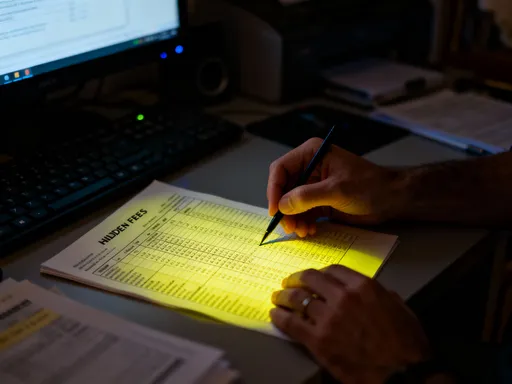

Insurance is a cornerstone of financial protection, but it is not a blanket solution. Many homeowners operate under the misconception that their standard policy covers all types of damage. In reality, most homeowner’s insurance policies exclude certain perils, particularly floods and earthquakes. A house damaged by rising water during a hurricane may not be covered unless the owner has a separate flood insurance policy through the National Flood Insurance Program or a private insurer. Similarly, earthquake coverage must be added as an endorsement or purchased separately. These gaps catch countless families off guard, leaving them responsible for tens or even hundreds of thousands of dollars in repairs.

Understanding policy exclusions is just the beginning. Even when coverage applies, limits and deductibles can significantly affect payouts. For example, a policy may cover structural damage but cap reimbursement for personal belongings at a low percentage of the home’s value. If your furniture, electronics, and clothing are destroyed, you may receive far less than needed to replace them. Some policies also impose special limits on high-value items like jewelry or artwork unless they are specifically scheduled. This means that without careful review, you could be underinsured in critical areas.

Deductibles are another crucial factor. In disaster-prone regions, insurers often use percentage-based deductibles for wind or hurricane damage, meaning you pay a percentage of your home’s insured value before coverage kicks in. A 5% deductible on a $300,000 home equals $15,000 out of pocket—a staggering amount for most families. While these deductibles help keep premiums lower, they shift significant risk to the policyholder. It’s essential to calculate whether you can afford your deductible in a crisis. If not, adjusting coverage or setting aside a dedicated fund for this purpose may be necessary.

Regular policy reviews are non-negotiable. Life changes—renovations, inflation, or rising construction costs—can make existing coverage inadequate. An appraisal from ten years ago may not reflect today’s rebuilding expenses. Experts recommend reviewing your policy annually and after any major home improvement. Discuss options with your agent, such as guaranteed replacement cost coverage, which pays to rebuild your home even if costs exceed the policy limit. While more expensive, this protection can prevent devastating shortfalls. The goal is not to eliminate all risk, but to ensure you understand exactly where you stand and make informed choices.

Securing Income and Managing Debt During Crisis

When a disaster disrupts your community, it often disrupts your income as well. Small business owners may lose customers or inventory. Hourly workers may face temporary layoffs. Even salaried employees can be affected if their workplace is damaged or utilities are down. Yet, bills continue to arrive: mortgages, car payments, insurance premiums, and credit card statements. Without a strategy, this mismatch between income and expenses can lead to missed payments, late fees, and damage to credit scores—compounding the crisis.

The first step is proactive communication. If you anticipate income loss, contact your employer as soon as possible to discuss options such as remote work, reduced hours, or temporary leave. Many companies have disaster response policies that include financial support or paid time off. Similarly, if you’re self-employed, reach out to clients to explain the situation and negotiate payment extensions. Transparency can preserve relationships and prevent misunderstandings.

For those who lose income entirely, government assistance programs can provide temporary relief. Unemployment insurance is available to eligible workers who lose jobs due to disasters, even if the closure is temporary. The application process varies by state, but filing early increases the chances of receiving benefits quickly. In severe cases, federal disaster aid through the Federal Emergency Management Agency (FEMA) may offer grants for housing, medical expenses, or essential needs. While these funds are not meant to cover all losses, they can help bridge the gap.

Equally important is managing existing debt. Contact lenders, credit card issuers, and utility companies to explain your situation. Many institutions offer hardship programs that allow for payment deferrals, reduced interest rates, or waived late fees. These arrangements are not automatic—you must request them. Keep records of all communications and agreements in writing. Avoid withdrawing from retirement accounts unless absolutely necessary, as early withdrawals can trigger taxes and penalties, reducing long-term security. The goal is to maintain financial stability without sacrificing future well-being.

Smart Spending and Avoiding Post-Disaster Scams

In the wake of a disaster, demand for services surges, and so do opportunities for exploitation. Unscrupulous contractors, fake charities, and price gouging are common threats. Homeowners desperate to repair roofs or restore power may hire the first person who knocks on the door, only to discover shoddy work or outright fraud. In some cases, contractors collect large deposits and disappear. Others use substandard materials, leaving homes vulnerable to further damage. These experiences are not just financially costly; they erode trust and prolong recovery.

Protecting yourself starts with verification. Always check a contractor’s license, insurance, and references before signing any agreement. In many states, home improvement contractors are required to be licensed. A quick online search through your state’s contractor licensing board can confirm legitimacy. Ask for proof of liability and workers’ compensation insurance to ensure you won’t be held liable for on-the-job injuries. Request photos of past projects and contact previous clients to hear about their experiences.

Get multiple written estimates. A significant difference in pricing may indicate that one bid is too low to be legitimate, possibly signaling the use of inferior materials or labor. Avoid paying in full upfront. Most reputable contractors require a deposit, but it should not exceed 10% to 30% of the total cost. Never pay in cash without a receipt. Use traceable payment methods like checks or credit cards whenever possible.

Be cautious of door-to-door solicitors or companies that claim to have “leftover materials” from another job. These are red flags for scam operations. Similarly, be skeptical of charities that lack transparency. Legitimate organizations will provide clear information about how funds are used. Donate through official websites or established platforms rather than unsolicited phone calls or street collections. By taking time to verify, compare, and document, you protect not only your money but your peace of mind during a vulnerable time.

Rebuilding Wealth: From Recovery to Resilience

Recovery is more than repairing what was lost—it’s an opportunity to build back stronger. Once immediate needs are met, the focus should shift to long-term financial health. This means prioritizing expenses wisely, using aid effectively, and reinforcing systems that promote stability. Many families, in their rush to return to normal, overlook this chance to improve their financial foundation. But with thoughtful planning, recovery can become a catalyst for lasting resilience.

Start by reassessing your budget. Disaster-related expenses may have altered your financial landscape. New insurance premiums, higher utility costs, or changes in income require updated planning. Identify non-essential spending that can be reduced temporarily to free up cash for rebuilding. At the same time, avoid cutting critical protections like health or life insurance. Use any insurance payouts or aid grants strategically—prioritize structural repairs, safety upgrades, and debt reduction over cosmetic improvements.

This is also the time to strengthen your emergency fund. If you dipped into savings during recovery, create a plan to replenish it gradually. Even small, consistent contributions can rebuild reserves over time. Consider increasing your target savings amount based on lessons learned. If a one-month cushion proved insufficient, aim for more. Similarly, review your insurance coverage with fresh eyes. Did you have adequate protection? Were there gaps that caused stress? Adjust policies to reflect your current understanding of risk.

Investing in preventive measures can also reduce future vulnerability. Upgrading windows to impact-resistant models, installing a generator, or elevating electrical systems may qualify for insurance discounts or tax incentives. These improvements not only enhance safety but can lower long-term costs. By viewing recovery as a process of adaptation, you transform a setback into a step forward.

The Mindset of Financial Resilience

Ultimately, financial resilience is as much about mindset as it is about money. It’s the confidence that comes from knowing you have a plan, the calm that follows preparation, and the sense of control that reduces anxiety in uncertain times. Many people delay financial planning because it feels overwhelming or because they believe disasters won’t happen to them. But resilience isn’t about predicting the future—it’s about preparing for it.

Building this mindset starts with small, consistent actions. Reviewing your insurance policy once a year, updating your emergency contact list, or practicing a financial evacuation plan with your family all contribute to a culture of readiness. These habits reduce fear by replacing uncertainty with knowledge. When a crisis occurs, you’re not reacting blindly; you’re following a path you’ve already mapped.

It also involves shifting from a reactive to a proactive financial identity. Instead of waiting for disaster to expose weaknesses, you continuously strengthen your foundation. You ask questions, seek advice, and update your plan as life changes. This ongoing practice ensures that resilience isn’t a one-time achievement but a living, evolving part of your financial life.

In a world where natural disasters are becoming more frequent and intense, financial preparedness is no longer optional—it’s essential. It’s not about eliminating risk, but about managing it wisely. By building safety nets, understanding insurance, protecting income, avoiding scams, and cultivating the right mindset, you equip yourself and your family to face the unexpected with strength and dignity. When disaster hits, your money may be tested—but with the right plan, it won’t be broken.