Why Timing the Market Feels Right—But Keeps Me Poor

Have you ever bought into a hot investment, only to watch it dip right after? I have—and more than once. The truth is, chasing returns without understanding the investment cycle is like driving at night without headlights. I’ve lost money, felt frustrated, and questioned my decisions. But over time, I’ve learned that real income growth isn’t about timing the market perfectly—it’s about working *with* the cycle, not against it. Emotional decisions, fueled by headlines and fear of missing out, often lead to buying high and selling low. The real path to lasting financial stability lies in recognizing patterns, managing behavior, and building systems that protect and grow wealth across market shifts. This is not about getting rich quick. It’s about staying rich over time by making smarter, more consistent choices.

The Trap of Quick Wins

Many investors begin their journey with the hope of fast income growth, drawn by stories of overnight success or dramatic stock surges. This desire for immediate results creates a powerful emotional pull, especially when markets rise and friends or neighbors boast about their gains. The problem is that this mindset shifts focus from long-term wealth building to short-term speculation. When returns become the primary measure of success, investors start making decisions based on excitement rather than strategy. They buy because prices are rising, not because the underlying asset is strong. This behavior often leads to entering the market at peak levels—just before a correction. The emotional high of being part of a rally quickly turns into anxiety when prices fall.

Panic becomes the next trigger. As markets decline, fear takes over. Investors who once celebrated their gains now worry about losing everything. The instinct to sell kicks in, often at the worst possible time—near the bottom of a downturn. This pattern of buying high and selling low is one of the most common reasons people fail to build lasting wealth. It’s not due to a lack of intelligence or access to information. It’s the result of reacting to emotions instead of following a disciplined plan. Frequent trading amplifies the problem, as each transaction carries fees and tax consequences that eat into returns over time.

Another trap is the illusion of control. Some investors believe they can outsmart the market by predicting its next move. They follow news closely, watch price charts, and interpret every economic report as a signal. But markets are influenced by countless variables—global events, interest rate changes, corporate earnings, and investor sentiment—many of which are unpredictable. Trying to time these shifts with precision is not only difficult but statistically unlikely to succeed over the long term. Studies have shown that even professional fund managers struggle to consistently beat the market through timing alone. For the average investor, the odds are even less favorable.

The cost of chasing quick wins isn’t just financial—it’s psychological. Each loss erodes confidence and makes future decisions harder. Investors may become either overly cautious, missing opportunities in healthy markets, or recklessly aggressive, hoping to recover past losses. Both extremes undermine the steady progress needed for real wealth accumulation. The alternative is not inaction, but intentionality. Instead of reacting to every market movement, the goal should be to build a strategy that works across different conditions. This requires patience, education, and a shift in mindset from seeking quick wins to valuing long-term consistency.

What Is the Investment Cycle, Really?

The investment cycle is a natural rhythm that financial markets follow over time. It consists of four main phases: accumulation, markup, distribution, and decline. These phases are not rigid or predictable in duration, but they do repeat with surprising regularity. Understanding them helps investors make sense of market behavior and avoid being caught off guard by sudden changes. The cycle is driven by supply and demand, investor psychology, and economic fundamentals. By recognizing where we are in the cycle, it becomes easier to adjust strategies and stay aligned with broader trends rather than fighting against them.

The first phase, accumulation, happens when prices are low and optimism is scarce. Smart investors begin buying assets quietly, often when others are fearful or disinterested. This phase is marked by low trading volume and minimal media attention. Because prices have already fallen, the risk of further losses is often lower, but the opportunity for future gains is higher. However, this is also the hardest phase emotionally, as it requires buying when everything feels uncertain. There are no guarantees, and progress seems slow. Yet, this is where long-term wealth is often built—through patience and conviction.

The next phase, markup, begins when confidence returns. Prices start to rise as more investors enter the market. Economic data improves, corporate earnings grow, and media coverage becomes more positive. This is the phase most people associate with investing success. It feels rewarding to see account balances go up, and new investors are drawn in by the momentum. But as prices climb, the risk of overvaluation increases. The assets that were once undervalued may now be fairly or even overpriced. The danger here is assuming that the upward trend will continue indefinitely. History shows that no bull market lasts forever.

Distribution follows the markup phase. At this point, early investors and institutions begin to sell, taking profits after strong gains. Prices may still fluctuate, but the overall upward momentum slows. Retail investors often remain optimistic, unaware that the tide is turning. This phase can be confusing because markets may still make new highs, but volume and participation start to weaken. It’s like a party where the hosts are leaving, but the music is still loud. For disciplined investors, this is a signal to reassess holdings and consider reducing exposure to overvalued assets.

The final phase, decline, occurs when selling pressure overwhelms buying interest. Prices fall, fear spreads, and negative headlines dominate. This is when many investors panic and sell at a loss, locking in their mistakes. Yet, this phase also sets the stage for the next cycle. As prices drop, assets become more attractively priced, eventually leading back to accumulation. The cycle is not a flaw in the system—it’s a feature. Markets move in cycles because human behavior does. By understanding this rhythm, investors can avoid being surprised by downturns and instead prepare for them as part of a normal financial journey.

Why Most People Get the Cycle Backwards

Despite the clarity of the investment cycle, most investors act in direct opposition to its logic. They buy during the markup phase, when excitement is high, and sell during the decline, when fear is strongest. This behavior is not random—it’s driven by deep-seated psychological biases that distort decision-making. One of the most powerful is recency bias, the tendency to believe that recent trends will continue. After a year of strong market gains, investors assume the next year will be just as good. They project the present into the future, ignoring historical patterns that suggest otherwise.

Herd mentality amplifies this effect. People feel safer following the crowd, especially when everyone seems to be making money. Social proof becomes a substitute for analysis. When neighbors talk about their winning stocks or coworkers brag about crypto gains, the pressure to join in grows. This fear of missing out, or FOMO, overrides caution and leads to impulsive decisions. But the crowd is often wrong at critical turning points. By the time an investment becomes widely popular, much of its potential gain has already been realized. What looks like a safe bet is often the start of a bubble.

Overconfidence is another major obstacle. After a few successful trades, some investors believe they have mastered the market. They start taking bigger risks, using leverage, or concentrating their portfolios in a single asset class. This overestimation of skill leads to larger losses when the market shifts. The truth is that luck plays a bigger role in short-term results than most people admit. A winning streak does not mean a strategy is sound. It may simply mean the investor was in the right place at the right time.

Media coverage worsens these biases. News outlets thrive on drama and urgency, so they highlight extreme events—record highs, sudden crashes, celebrity investors—while ignoring the slow, steady progress of disciplined investing. Headlines scream about daily price swings, creating the illusion that constant attention and action are necessary. This noise makes it harder to focus on long-term goals. Investors who check their portfolios too frequently are more likely to react emotionally, even if their overall strategy hasn’t changed.

The result is a cycle of self-sabotage: buy high, sell low, repeat. This pattern persists not because people lack information, but because they lack emotional control. Understanding the investment cycle is only half the battle. The other half is managing the instincts that lead to poor timing. The solution is not to eliminate emotions—this is impossible—but to build systems that reduce their influence. Rules-based investing, automated contributions, and regular reviews can help create distance between feeling and action. Over time, these habits lead to better outcomes, not because they predict the future, but because they prevent costly mistakes.

Aligning Income Goals with Market Phases

Once investors understand the investment cycle, the next step is to align their strategies with each phase. This doesn’t require perfect timing or complex forecasting. Instead, it’s about making thoughtful adjustments based on the broader environment. The goal is to protect capital during risky periods and position for growth when opportunities arise. By matching investment behavior to market conditions, it becomes possible to generate steady income without chasing performance.

During the accumulation phase, when prices are low and sentiment is weak, the focus should be on building positions in high-quality assets. Dividend-paying stocks, for example, can provide income even when prices are flat. These companies often have strong balance sheets and consistent earnings, making them resilient during downturns. Buying them at discounted prices increases long-term return potential. Dollar-cost averaging—investing a fixed amount regularly—works well here because it reduces the risk of buying too much at a high price. Over time, this approach smooths out purchase costs and builds a solid foundation.

In the markup phase, when prices are rising and confidence is growing, the emphasis shifts to balance. While it may be tempting to increase exposure to gain more, this is also when valuations become stretched. A disciplined investor will avoid chasing hot sectors and instead focus on rebalancing. This means selling a portion of assets that have appreciated significantly and reinvesting in areas that are lagging. Rebalancing maintains the original risk level and prevents the portfolio from becoming overly concentrated in one area. It also forces the investor to sell high and buy low—a counterintuitive but effective strategy.

During distribution, when early sellers are taking profits, caution becomes more important. This is not the time to panic, but it is a time to review goals and risk tolerance. Some investors choose to lock in gains by shifting a portion of their portfolio into more stable assets, such as bonds or cash. This reduces exposure to potential declines without exiting the market entirely. Others may use this phase to strengthen their emergency fund or pay down high-interest debt, improving overall financial health. The key is to act deliberately, not reactively.

In the decline phase, the priority is preservation. Income strategies should focus on stability and liquidity. High-quality bonds, short-term treasuries, and dividend stocks with reliable payouts can continue to generate returns even in falling markets. It’s also a time to avoid new risks and resist the urge to speculate. For those still contributing to investments, such as through a retirement plan, this phase offers a hidden benefit: buying assets at lower prices. Over time, these purchases can significantly boost long-term returns when the market recovers.

Risk Control: Protecting Gains Before They Vanish

Risk management is not about avoiding risk altogether—that’s impossible in investing. It’s about understanding risk and taking steps to protect against the most damaging outcomes. Many investors focus only on growth, assuming that rising markets will continue. But history shows that every bull market ends, and every portfolio faces drawdowns. The difference between successful and unsuccessful investors is not how much they make during good times, but how much they keep during bad times. Protecting gains is just as important as achieving them.

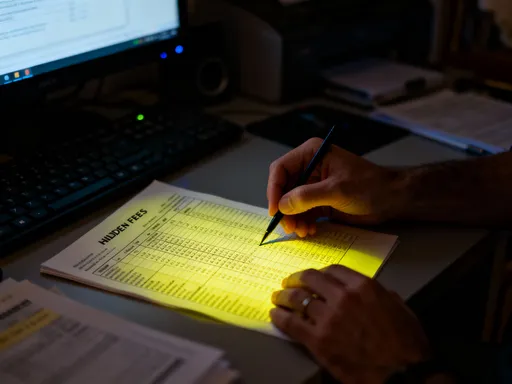

One effective method is setting exit rules. These are predetermined conditions for selling an investment, such as a specific drop in price or a change in fundamentals. For example, an investor might decide to sell a stock if it falls 15% below the purchase price. This removes emotion from the decision and prevents small losses from becoming large ones. Another approach is using trailing stops, which automatically sell an asset if it drops a certain percentage from its highest point. This allows gains to run while providing a safety net if the trend reverses.

Maintaining liquidity is another key strategy. Having cash or cash-equivalent assets on hand reduces the need to sell investments at a loss during emergencies. A common rule is to keep three to six months of living expenses in a safe, accessible account. This buffer provides peace of mind and prevents forced sales in downturns. It also creates flexibility—when markets are low, available cash can be used to buy quality assets at attractive prices.

Diversification remains one of the most powerful tools for risk control. Spreading investments across different asset classes—stocks, bonds, real estate, and alternatives—reduces the impact of any single failure. When one area struggles, others may hold steady or even gain. Rebalancing supports this by ensuring the portfolio stays aligned with the original risk profile. Over time, small, consistent actions compound into significant protection. They don’t guarantee profits, but they increase the odds of long-term success.

Practical Tools That Actually Work

Understanding the investment cycle and managing risk are important, but knowledge alone isn’t enough. The real challenge is putting these ideas into practice consistently. This is where simple, practical tools make a difference. They don’t require advanced skills or constant monitoring. Instead, they create structure and accountability, helping investors stay on track even when emotions run high.

One of the most effective tools is the calendar-based review. Setting a regular schedule—quarterly or semi-annually—to assess the portfolio removes the temptation to react to daily news. During these reviews, investors can check asset allocation, evaluate performance, and rebalance if needed. The key is consistency. Frequent trading increases costs and risk, while long gaps between reviews can lead to missed adjustments. A scheduled check-in provides balance, ensuring the portfolio evolves with changing conditions without being driven by short-term noise.

Automated investing is another powerful habit. Setting up automatic transfers to investment accounts ensures consistent contributions, regardless of market conditions. This supports dollar-cost averaging and removes the need to time entries. Automation also reduces emotional interference. When money moves without a decision, there’s no chance to hesitate during downturns or overcommit during rallies. Over time, this steady approach builds wealth more reliably than sporadic, emotionally driven actions.

Journaling investment decisions is a less common but highly valuable practice. Writing down the reasons for buying or selling an asset creates clarity and accountability. Months later, when reviewing past choices, investors can see whether their decisions were based on logic or emotion. This reflection builds self-awareness and improves judgment over time. It also helps distinguish between strategy and speculation. A well-documented process reinforces discipline and makes it easier to stay focused on long-term goals.

Building a Cycle-Aware Mindset

The journey to financial stability is not about making perfect decisions. It’s about developing a mindset that supports consistent, rational behavior over time. A cycle-aware investor doesn’t try to outguess the market. Instead, they accept its rhythms and work within them. They understand that downturns are not failures, but natural parts of the process. They see volatility not as a threat, but as an opportunity to buy quality assets at better prices. This perspective reduces stress and increases confidence.

Patience is the foundation of this mindset. Wealth is built slowly, through repeated small actions—regular saving, disciplined investing, and risk management. There are no shortcuts, but there is progress. Consistency compounds, not just in returns, but in confidence and control. Emotional detachment doesn’t mean indifference. It means making decisions based on a plan, not on fear or excitement. It means trusting the process, even when results aren’t immediate.

Success is not measured by beating the market in a single year. It’s measured by achieving personal financial goals—funding retirement, supporting family, gaining freedom—without losing sleep. The investor who stays the course, avoids major mistakes, and keeps fees low will almost always outperform the one who chases trends and times poorly. Mastery of the investment cycle is not a destination. It’s a lifelong practice of learning, adjusting, and staying aligned with reality. The reward is not just more money, but more peace of mind.