Wealth Without the Worry: A Real Talk on Smarter Money Moves

You’ve probably felt it—that quiet stress about money, even when things seem fine. I did too, until I stopped chasing quick wins and started treating wealth like a system, not luck. This isn’t about get-rich-quick schemes or complex charts. It’s about real, practical steps I’ve tested—balancing growth, safety, and peace of mind. For years, I thought financial security meant earning more or finding the next hot stock. But the truth is, lasting strength comes from structure, consistency, and clarity. If you’re ready to build lasting financial strength without the hype, let’s walk through what actually works.

The Hidden Cost of Ignoring Your Financial Big Picture

Many people manage money in isolated pieces—savings in one account, retirement in another, maybe a little invested here and there—without ever stepping back to see how it all fits together. This fragmented approach creates blind spots that can quietly undermine even the most disciplined saver. I learned this the hard way when I thought I was doing well, only to discover during a financial review that nearly 70% of my investments were tied to a single asset class. That imbalance didn’t show up in my monthly statements, but it posed a serious risk if that market shifted. The moment I mapped everything—checking accounts, retirement funds, debts, insurance policies—I saw patterns I’d missed for years. A holistic financial picture isn’t just a list of numbers; it’s a roadmap that aligns your money with your actual life goals.

Without this big-picture view, it’s easy to chase short-term wins while neglecting long-term security. For example, someone might celebrate a high return on a single investment while overlooking rising credit card debt that’s eroding their net worth. Or they might save diligently for retirement but leave no accessible funds for emergencies, creating unnecessary stress. The real cost of this oversight isn’t just financial—it’s emotional. Uncertainty breeds anxiety, and anxiety leads to reactive decisions: selling investments at a loss during a market dip, or avoiding investing altogether out of fear. A comprehensive assessment brings clarity, and clarity brings confidence. It allows you to answer simple but powerful questions: Where is my money? Is it working efficiently? Does my strategy reflect where I want to be in ten years?

Building this full picture starts with gathering basic information. List all assets—bank accounts, investment portfolios, real estate, retirement plans—and assign current values. Then list all liabilities: mortgages, car loans, credit card balances, personal debts. Subtract liabilities from assets to determine your net worth. This number isn’t a judgment; it’s a starting point. Next, map your cash flow: track monthly income and expenses to understand how money moves in and out of your life. Only then can you evaluate whether your current strategy supports your goals—whether that’s early retirement, funding education, or simply sleeping better at night. This process doesn’t need to be perfect, and it shouldn’t be done once and forgotten. Revisiting it annually, or after major life events, keeps your financial plan relevant and resilient.

Building Your Foundation: Why Stability Comes Before Speed

Before you can grow wealth with confidence, you need a solid foundation. Just as a house requires a strong base to withstand storms, your finances need stability to handle life’s unexpected turns. I once believed that investing was the fastest path to financial freedom—until a sudden job transition made me realize how fragile my sense of security really was. Despite having a growing portfolio, I felt anxious because I didn’t have enough accessible funds to cover even a few months of expenses. That experience taught me a crucial lesson: liquidity and preparedness matter more than aggressive returns in the early stages. Stability isn’t flashy, but it’s what gives you the freedom to make thoughtful decisions instead of reactive ones.

The cornerstone of financial stability is an emergency fund. This isn’t just a savings account—it’s a buffer that protects you from turning temporary setbacks into long-term damage. Most financial advisors recommend three to six months’ worth of essential living expenses in a liquid, easily accessible account. For someone with dependents or a variable income, that range might extend to eight or even twelve months. The goal is to cover necessities like housing, food, utilities, and insurance without relying on credit cards or loans. This fund should be separate from everyday spending accounts to avoid temptation, yet accessible enough to withdraw quickly if needed. High-yield savings accounts or short-term certificates of deposit are practical choices because they offer modest growth without risking principal.

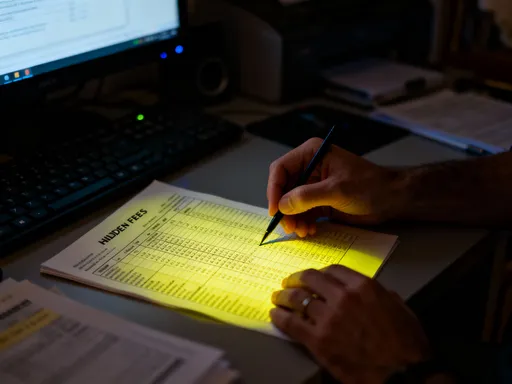

Equally important is managing debt wisely. Not all debt is harmful—mortgages and student loans can be tools for building long-term value—but high-interest consumer debt, like credit card balances, can quickly spiral out of control. The key is to distinguish between productive debt, which supports wealth-building, and destructive debt, which drains it. A strategic approach includes prioritizing high-interest debts for repayment while maintaining on-time payments for others. Some people use the avalanche method—paying off debts with the highest interest rates first—to minimize total interest paid. Others prefer the snowball method—clearing smaller balances first—to build momentum and motivation. Both work; the best method is the one you can stick with consistently.

Stability also means knowing your priorities. When resources are limited, it’s essential to decide what comes first: building savings, paying down debt, or funding retirement. For many, the answer is sequential—establish a small emergency cushion, then tackle high-interest debt, then expand savings and invest. This phased approach prevents burnout and builds confidence. Remember, financial strength isn’t about doing everything at once. It’s about laying one solid brick at a time, creating a foundation that can support the weight of your ambitions without cracking under pressure.

Growing Wealth: Where to Put Your Money So It Works for You

Once your foundation is secure, you can focus on growing your wealth in ways that align with your goals and comfort level. This isn’t about chasing the highest possible returns—it’s about building sustainable, long-term growth while managing risk. I spent years searching for the “perfect” investment, only to realize that no single option works for everyone. What matters most is fit: how an investment aligns with your time horizon, risk tolerance, and financial objectives. Over time, I tested different strategies, from passive index funds to real estate partnerships, and found that a diversified approach delivered the most consistent results without unnecessary stress.

Understanding the major asset classes is the first step. Stocks represent ownership in companies and historically offer higher long-term returns, but they come with volatility. When the economy slows or uncertainty rises, stock prices can drop sharply. Bonds, on the other hand, are loans to governments or corporations that pay regular interest. They tend to be less volatile than stocks and can provide stability during market downturns. Real estate offers both income through rent and potential appreciation in value, but it requires more active management and carries market-specific risks. Alternatives—such as commodities, private equity, or peer-to-peer lending—can add further diversification but often come with higher complexity and lower liquidity.

Diversification isn’t just a buzzword; it’s a fundamental principle of risk management. By spreading your money across different asset classes, industries, and geographic regions, you reduce the impact of any single underperforming investment. For example, if the stock market declines, bonds might hold steady or even rise, helping to balance your overall portfolio. The right mix depends on your individual situation. A younger investor with decades until retirement might allocate more to stocks, accepting short-term fluctuations for greater growth potential. Someone nearing retirement might shift toward bonds and other stable assets to preserve capital. The goal isn’t to time the market perfectly but to create a balanced allocation that reflects your life stage and emotional comfort.

How you invest matters as much as what you invest in. Low-cost index funds and exchange-traded funds (ETFs) offer broad market exposure with minimal fees, making them ideal for long-term investors. These funds automatically diversify across hundreds or even thousands of securities, reducing the risk of picking individual stocks. Automated investing platforms can simplify the process by setting up regular contributions and rebalancing your portfolio over time. Real estate can also play a role, whether through direct ownership, real estate investment trusts (REITs), or crowdfunding platforms. The key is to invest in ways that require minimal ongoing effort, so you can stay consistent without constant monitoring. Growth isn’t about making bold moves—it’s about making steady, informed ones.

Protecting What You’ve Built: Risk Isn’t Just About Markets

Many people think of financial risk solely in terms of market downturns—when stock values drop and portfolios shrink. But real risk is broader and often quieter. It includes inflation slowly reducing your purchasing power, overconcentration in a single investment, or unexpected life events that force you to sell assets at a loss. I learned this after holding too much of my portfolio in one sector. When that market slowed, my entire financial plan felt unstable. That experience shifted my focus from just growing wealth to actively protecting it. Risk management isn’t about eliminating uncertainty—that’s impossible—but about preparing for it in practical ways.

One of the most effective tools is regular portfolio rebalancing. Over time, some investments grow faster than others, shifting your original asset allocation. If stocks perform well, they might grow from 60% of your portfolio to 75%, exposing you to more risk than intended. Rebalancing means selling some of the overperforming assets and buying more of the underrepresented ones to return to your target mix. This practice enforces discipline—selling high and buying low—and keeps your risk level consistent. Most investors rebalance annually or when allocations drift more than 5% from their targets.

Another strategy is understanding correlation—the degree to which different investments move in relation to each other. If all your assets tend to rise and fall together, your portfolio lacks true diversification. For example, during economic downturns, many stock markets decline simultaneously. Adding assets with low or negative correlation—like certain bonds, real estate, or commodities—can help smooth out volatility. Insurance also plays a strategic role in risk protection. Life, disability, and long-term care insurance aren’t just expenses—they’re safeguards that prevent a personal crisis from becoming a financial disaster. Umbrella liability policies add another layer of protection for those with significant assets.

Inflation is a silent risk that many overlook. Even at a modest 3% annual rate, inflation can cut purchasing power in half over 25 years. That means money saved today will buy less in the future unless it earns a return that keeps pace. Investments like stocks, real estate, and Treasury Inflation-Protected Securities (TIPS) have historically outpaced inflation over the long term. Holding too much cash might feel safe, but it can erode wealth silently. The goal isn’t to avoid risk entirely—it’s to understand it, measure it, and build defenses that allow you to move forward with confidence.

Making It Real: Simple Systems That Keep You on Track

Even the best financial plan fails without consistency. I used to swing between extremes—checking my accounts daily during market swings or ignoring them completely for months. Both habits hurt my progress. What changed was building simple, repeatable systems that didn’t rely on motivation or perfect timing. Systems remove emotion from decision-making and create structure that supports long-term success. They don’t have to be complex; in fact, the most effective ones are easy to maintain and automate.

One powerful tool is automatic transfers. Setting up regular, scheduled contributions to savings and investment accounts ensures that money moves where it should without requiring constant attention. Whether it’s $100 a month or 10% of each paycheck, automation makes saving a default action rather than a decision. Similarly, scheduling quarterly or annual portfolio reviews prevents neglect and keeps you aligned with your goals. These check-ins don’t need to take hours—just enough time to assess performance, rebalance if needed, and confirm that your strategy still fits your life.

Another helpful practice is creating tiered accounts for different purposes. For example, one account for emergency funds, another for near-term goals like vacations or home repairs, and separate investment accounts for long-term objectives like retirement. This mental and physical separation makes it easier to avoid dipping into long-term savings for short-term wants. Naming accounts by purpose—“Emergency Fund,” “Daughter’s College,” “Retirement Growth”—can reinforce their role and reduce impulsive withdrawals.

Defining clear decision rules also reduces stress. For instance, deciding in advance under what conditions you’d adjust your investment strategy—such as a major life change, a shift in goals, or a significant market event—prevents reactive choices. You might set a rule to rebalance annually or to consult a financial advisor before making changes above a certain amount. These guidelines act like guardrails, keeping you on course even when emotions run high. The best financial systems aren’t about perfection—they’re about progress, consistency, and peace of mind.

Navigating Life Changes: Why Flexibility Beats Perfection

Financial plans don’t exist in isolation—they must adapt as life evolves. Major transitions like marriage, parenthood, career shifts, relocation, or health changes can all reshape your financial landscape. I learned this when I moved to a new state and faced different tax laws, housing costs, and job opportunities. My original investment strategy, designed for a different cost of living and career path, no longer fit. Sticking rigidly to the old plan would have ignored my new reality. Instead, I reassessed my goals, adjusted my budget, and reallocated my investments to reflect my current situation. Flexibility isn’t a sign of failure—it’s a sign of wisdom.

The key is knowing when to reassess. Major life events are natural triggers, but so are economic shifts or changes in personal priorities. If you decide to work part-time, retire early, or support aging parents, your financial strategy should reflect those choices. This doesn’t mean reacting to every market fluctuation or news headline. It means making intentional, informed adjustments when your life direction changes. For example, someone approaching retirement might shift from growth-oriented investments to more income-focused ones. A parent with young children might increase life insurance coverage or prioritize college savings.

Adjusting your timeline is another aspect of flexibility. Unexpected expenses or income changes might delay a goal like buying a home or retiring. That’s okay. What matters is maintaining the discipline to keep saving and investing, even if the target date shifts. Redefining success is part of this process. Financial success isn’t just about hitting a number—it’s about having choices, security, and peace of mind. A flexible plan allows you to honor your values, whether that means working less, traveling more, or supporting family. The best financial strategy isn’t rigid—it’s responsive, evolving alongside your life.

The Long Game: Wealth as Peace of Mind, Not Just a Number

In the end, financial success isn’t measured only by the size of your portfolio. It’s measured by the quality of your life—your ability to handle surprises, make meaningful choices, and support the people you care about without constant worry. I used to measure progress by account balances, but over time, I’ve come to value resilience more. True wealth isn’t about having the most—it’s about having enough, and knowing it. It’s the confidence that comes from knowing you’re prepared, that your money is working for you, and that you’re not living paycheck to paycheck.

Building sustainable wealth is a long-term journey that balances growth and preservation, risk and safety, ambition and contentment. It requires patience, discipline, and the willingness to adjust course when needed. But it also brings freedom—the freedom to work on your own terms, to give generously, and to face the future with calm instead of fear. By focusing on systems rather than shortcuts, on clarity rather than complexity, you create a financial life that supports your values and goals. This isn’t about perfection; it’s about progress. And every smart, thoughtful move you make brings you closer to not just more money, but more peace, more control, and a deeper sense of security. That’s the real win.