How I Mastered VAT Planning Without Crossing the Compliance Line

You’re juggling invoices, deadlines, and tax rules that change faster than the weather. I’ve been there—staring at a VAT bill that felt too high, wondering if I could legally reduce it. After years of trial, error, and one close call with an audit, I learned how to plan smartly while staying fully compliant. This isn’t about loopholes—it’s about strategy, clarity, and avoiding costly mistakes. Let’s walk through what actually works.

The Hidden Cost of Getting VAT Wrong

Value Added Tax (VAT) may seem like just another line on a financial statement, but mismanaging it can ripple through a business in ways far beyond a single tax return. Many small and medium-sized enterprises unknowingly overpay VAT or make reporting errors that, while seemingly minor, accumulate into significant financial strain. The consequences extend beyond numbers: they affect cash flow, relationships with suppliers, and even public trust. A business that consistently files inaccurate returns may attract scrutiny from tax authorities, leading to audits, penalties, and reputational damage that can be difficult to repair. These outcomes are not reserved for large corporations or deliberate offenders—small businesses are often more vulnerable due to limited resources and expertise.

Consider a family-run retail store that mistakenly applies the standard VAT rate to goods that qualify for a reduced rate. Over a year, this error could result in thousands of dollars in overpaid tax—money that could have been reinvested in inventory or staff. Worse, if discovered during an audit, the business may face not only the repayment of undercharged VAT from customers but also interest and penalties. The financial impact is compounded by the emotional toll: stress, sleepless nights, and the distraction from core operations. In some cases, prolonged VAT mismanagement has even led to temporary closures or the sale of assets to cover unexpected liabilities.

Cash flow disruptions are among the most immediate risks. VAT is typically paid on a periodic basis—monthly or quarterly—while input tax refunds may take time to process. If a business fails to reclaim eligible input tax due to poor recordkeeping, it effectively funds the government’s operations interest-free. This silent drain can strain operations, especially for businesses with tight margins. Additionally, inconsistent VAT treatment across invoices can confuse clients and damage credibility. A consulting firm that inconsistently applies VAT to cross-border services may lose client trust, leading to contract losses or reputational harm in competitive markets.

The stakes are not purely financial but operational. A business that operates under the shadow of potential non-compliance may hesitate to grow, fearing that expansion will increase exposure. It may avoid new markets, delay investments, or limit hiring—all to stay within perceived tax safety zones. This self-imposed constraint stifles innovation and opportunity. The lesson is clear: VAT missteps, even unintentional ones, carry real costs. Proactive planning is not a luxury; it is a necessity for sustainable business health. Avoiding these pitfalls begins with understanding what VAT planning truly entails—and what it does not.

What VAT Planning Really Means (And What It Doesn’t)

VAT planning is often misunderstood, sometimes confused with aggressive tax avoidance or even evasion. The truth is, legitimate VAT planning operates firmly within the boundaries of the law. It is not about finding ways to pay nothing—it is about ensuring that a business pays the correct amount, at the right time, in the most efficient manner. This distinction is crucial. Tax evasion, which involves deliberately underreporting income or inflating expenses, is illegal and carries severe penalties. Tax avoidance, particularly when it exploits technicalities without economic substance, may be challenged by tax authorities and result in disallowed claims. In contrast, VAT planning is a responsible financial practice focused on clarity, compliance, and optimization.

At its core, VAT planning involves analyzing a business’s operations to identify opportunities for lawful reduction of tax burdens. This could mean correctly applying reduced rates where eligible, ensuring full recovery of input tax on business expenses, or aligning invoicing practices with return cycles to improve cash flow. For example, a manufacturing company that purchases raw materials can reclaim the VAT paid on those inputs, reducing its net liability. Failing to do so is not prudence—it is leaving money on the table. Effective planning ensures that every reclaimable credit is captured, every exemption is properly applied, and every return is accurate.

One of the most powerful benefits of VAT planning is its impact on pricing strategy. When a business understands its true tax obligations, it can price products and services more accurately, avoiding both undercharging customers and overburdening itself. A catering service that correctly identifies which events are subject to standard VAT and which qualify for exemptions can set competitive prices without sacrificing profitability. This precision builds confidence in financial decision-making and strengthens customer relationships through transparency.

Moreover, good VAT planning supports long-term compliance. By embedding sound practices into daily operations—such as training staff on proper invoicing, maintaining organized records, and conducting regular reviews—businesses reduce the risk of errors. This proactive stance not only minimizes the chance of audits but also ensures that if an audit does occur, the business is prepared. The goal is not to outsmart the system but to work with it effectively. When done right, VAT planning becomes a tool for financial resilience, enabling businesses to focus on growth rather than crisis management.

Mapping Your VAT Exposure: Know Where You Stand

Before any strategic planning can take place, a business must have a clear understanding of its current VAT position. This begins with a comprehensive assessment of all taxable supplies, exemptions, and liabilities. Without this foundation, even well-intentioned efforts can lead to mistakes. The first step is identifying which goods and services are subject to VAT, at what rate, and in which jurisdictions. This may seem straightforward, but complexities arise in areas such as digital services, cross-border transactions, and mixed-use assets. A home-based business selling handmade crafts online, for instance, may not realize that selling to customers in other countries triggers different VAT obligations.

One of the most common challenges is distinguishing between input tax and output tax. Output tax is the VAT a business charges on its sales, while input tax is the VAT it pays on purchases. The difference between the two determines the amount due to the tax authority or eligible for refund. However, not all input tax is recoverable. Expenses that are personal, non-business-related, or fall under specific restrictions—such as entertainment or certain vehicles—cannot be reclaimed. A freelance designer who uses a portion of their home as an office must carefully apportion utility costs to claim only the business-related portion of input tax. Misjudging this split can lead to overclaims and future adjustments.

Another frequent issue is the misclassification of services. Some services are exempt from VAT, such as financial services or education, while others are outside the scope entirely, like employment income. A tutoring business might assume all lessons are exempt, not realizing that certain types of private coaching are taxable. Similarly, e-commerce businesses often struggle with the Mini One Stop Shop (MOSS) system or local VAT registrations in foreign markets. Selling digital products across borders requires careful tracking of customer location and compliance with destination-based rules. Without proper systems in place, businesses risk non-compliance and unexpected liabilities.

Partial exemption is another area where clarity is essential. Businesses that make both taxable and exempt supplies must calculate how much input tax they can recover using a法定 method, such as the standard fraction or a special method approved by the tax authority. A farm that sells produce (taxable) and offers farm stays (potentially exempt) must apply these rules accurately. The process can be complex, but it is necessary to avoid disallowed claims. By mapping out these elements systematically, businesses gain visibility into their exposure and can make informed decisions. This self-assessment is not a one-time task but an ongoing process that evolves with the business.

Smart Timing: How Scheduling Impacts VAT Outcomes

The timing of financial transactions can have a direct impact on VAT liabilities, and when managed thoughtfully, it becomes a powerful tool for cash flow optimization. Unlike manipulation or deferral schemes that risk non-compliance, smart timing involves aligning legitimate business activities with VAT return periods to improve liquidity without altering legal obligations. For example, a business facing a large VAT payment at the end of a quarter might choose to delay a major equipment purchase until the next period, thereby deferring the output tax liability. Conversely, accelerating the receipt of invoices for business expenses allows for earlier input tax recovery, improving available cash.

Consider a construction company that operates on project-based income. Receiving a large payment near the end of a VAT period increases output tax liability immediately, potentially creating a cash crunch. By negotiating contract terms to spread payments across periods, the company can smooth its VAT obligations and maintain more stable cash flow. Similarly, a service provider might delay issuing an invoice until after the period-end if the client’s payment timeline allows, effectively pushing the tax liability forward. These adjustments do not reduce the total tax owed—they simply manage when it is paid, which can be critical for businesses with seasonal revenue.

Another effective strategy is aligning asset purchases with periods of high input tax recovery. A bakery planning to upgrade its ovens can time the purchase to coincide with a period of strong sales, ensuring that the increased input tax claim offsets a larger output tax liability. This natural balancing reduces the net payment to the tax authority. It is important, however, that such decisions are driven by business needs, not tax motives alone. Tax authorities scrutinize patterns that suggest artificial manipulation, such as consistently making purchases just before filing deadlines without operational justification.

Timing also affects cross-border transactions. For businesses selling to customers in multiple countries, understanding the VAT treatment of dispatch dates versus invoice dates is essential. In some jurisdictions, VAT liability arises when goods are shipped; in others, when the invoice is issued. Aligning these dates strategically—while remaining truthful—can help manage cash flow across different tax regimes. The key is consistency and documentation. Every timing decision should be supported by clear records and reflect genuine business activity. When done ethically, timing becomes not a trick, but a disciplined financial practice.

Structuring for Compliance and Efficiency

How a business is structured can significantly influence its VAT obligations and opportunities for efficient management. The choice of legal entity—sole proprietorship, partnership, or limited company—affects registration thresholds, reporting requirements, and liability exposure. Beyond entity selection, operational segmentation can enhance control. Some businesses choose to register multiple divisions separately, particularly when they operate in different sectors with varying VAT treatments. For example, a company that runs both a taxable retail store and an exempt educational workshop might benefit from separate accounting to prevent the dilution of input tax recovery.

Splitting activities can be a legitimate strategy when it reflects genuine economic separation. A property owner who rents out commercial spaces (subject to VAT) and residential units (often exempt) may establish separate entities or accounting systems to isolate liabilities. This prevents the residential activity from affecting the ability to reclaim input tax on shared expenses like maintenance or utilities. However, tax authorities watch for artificial splits designed solely to reduce tax. If the divisions lack operational independence—such as shared branding, management, or bank accounts—the arrangement may be challenged.

Another consideration is group registration, where related companies file a single VAT return. This can streamline compliance and allow for internal netting of transactions, reducing administrative burden. However, it also means joint and several liability—all members are responsible for the full amount owed. A parent company may hesitate to include a subsidiary with unstable finances, fearing exposure. The decision must balance efficiency with risk, and professional advice is often necessary to navigate these choices.

Ultimately, structure should serve the business, not the tax code. Decisions should be based on long-term strategy, market demands, and operational logic. When VAT considerations align with sound business reasoning, they strengthen compliance and create sustainable advantages. A well-structured business is not only easier to manage but also more resilient in the face of audits or regulatory changes.

Documentation: Your First Line of Defense

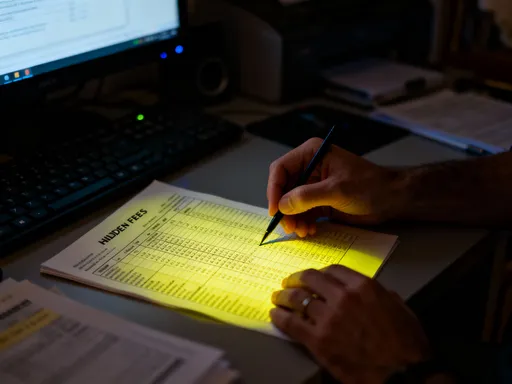

No VAT strategy is complete without robust documentation. Records are not merely administrative tasks—they are legal requirements and the primary defense in an audit. Tax authorities do not expect perfection, but they do expect accuracy, consistency, and transparency. A well-documented business can respond to inquiries confidently, resolve discrepancies quickly, and demonstrate good faith compliance. In contrast, disorganized or incomplete records can turn a minor error into a major investigation, leading to penalties even when the underlying issue is small.

The foundation of strong documentation is the invoice. Every invoice must include mandatory elements: seller and buyer details, date, invoice number, description of goods or services, quantity, unit price, VAT rate, and total amount. Missing any of these can invalidate the right to reclaim input tax. A consulting firm that receives a supplier invoice without a VAT number, for instance, cannot claim the tax back, resulting in a direct financial loss. Regular internal reviews of incoming and outgoing invoices can catch these issues early.

Equally important are records of expenses, bank statements, contracts, and internal calculations. A business claiming partial exemption must keep evidence of its apportionment method, such as time logs or usage records. Digital recordkeeping systems can automate much of this process, reducing human error and improving retrieval speed. Cloud-based accounting software, for example, can link bank transactions to invoices, flag missing data, and generate reports for filing. These tools not only save time but also enhance accuracy.

Internal audits are another critical component. Conducting periodic reviews—quarterly or biannually—helps identify patterns, correct mistakes, and reinforce compliance culture. Staff training ensures that everyone involved in financial processes understands their role. A small retail business might designate one person to manage VAT records, with a second to review them before filing. This simple check-and-balance system reduces risk. Strong documentation is not about creating a mountain of paper—it is about building a reliable, auditable trail that supports every financial decision.

Staying Ahead: Monitoring Changes Without Panic

Tax laws are not static. Governments update VAT rules in response to economic conditions, technological changes, and international agreements. For businesses, staying informed is not optional—it is part of responsible financial management. However, constant vigilance should not descend into anxiety. The goal is not to react to every minor update but to establish a sustainable system for monitoring and adapting to changes.

Reliable sources are essential. Official tax authority websites, newsletters, and public consultations provide accurate, up-to-date information. Subscribing to these ensures that businesses receive announcements directly, reducing reliance on secondhand interpretations. Professional networks, such as industry associations or accounting groups, also offer valuable insights. Members often share experiences, practical tips, and warnings about common pitfalls, creating a collective knowledge base.

Internal processes should include regular review meetings—perhaps quarterly—where financial leaders assess recent changes and their impact. A software update to accounting systems, a new digital services rule, or a shift in import VAT procedures can all affect operations. By discussing these in advance, businesses can adjust workflows, retrain staff, and update documentation before deadlines arrive. This proactive approach turns compliance from a reactive burden into a strategic advantage.

Finally, cultivating a mindset of continuous learning reduces fear. VAT is complex, but it is learnable. Business owners who invest time in understanding the principles—rather than memorizing every rule—develop the confidence to make sound decisions. They recognize that change is inevitable, but with the right systems, it is manageable. Over time, this calm, informed approach becomes a competitive edge, allowing businesses to operate with clarity and resilience.

Building Confidence Through Clarity

True financial strength does not come from chasing every possible deduction or fearing every regulatory update. It comes from understanding the rules and working within them wisely. VAT planning, when grounded in compliance and clarity, is not a risky maneuver—it is a responsible business practice. It empowers owners to take control of their finances, reduce uncertainty, and create space for growth. The goal is not to achieve perfection but to make steady, informed progress.

By mapping exposure, timing transactions thoughtfully, structuring operations wisely, and maintaining strong records, businesses build a foundation of resilience. They are less likely to face penalties, more capable of managing cash flow, and better positioned to adapt to change. These benefits extend beyond the balance sheet—they reduce stress, improve decision-making, and enhance credibility with clients and partners.

In the end, mastering VAT is not about outsmarting the system. It is about mastering your own business. When you know where you stand, what you owe, and how to manage it efficiently, you gain more than tax savings—you gain confidence. And with confidence comes the freedom to focus on what matters most: building a sustainable, successful enterprise for the long term.