How I Cracked Financial Freedom by Mastering Hidden Costs

What if the biggest barrier to financial freedom isn’t your income—but the costs you don’t even see? I used to think I was saving smartly, only to realize I was leaking money in ways I never noticed. This isn’t about skipping coffee; it’s about rethinking how every dollar moves. After years of trial, error, and real-world testing, I uncovered the real cost drivers holding people back. Let me show you what actually works—no hype, just clarity. The journey to financial control begins not with earning more, but with seeing clearly. And once you do, the path forward becomes not just possible, but inevitable.

The Invisible Tax: Why Hidden Costs Block Financial Freedom

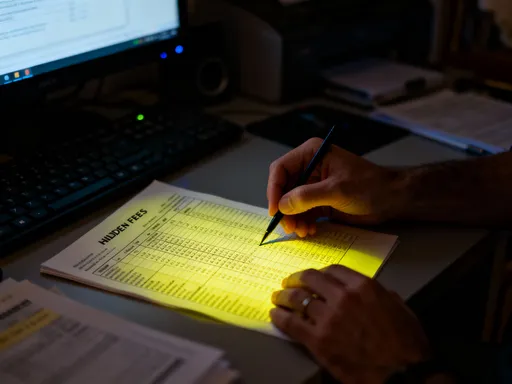

Most people believe that financial freedom is a function of income—earn more, save more, achieve more. But in reality, the true obstacle isn’t how much you make; it’s how much you lose without realizing it. These unseen losses are what financial experts often call the “invisible tax”—not imposed by governments, but by habits, systems, and overlooked details that quietly drain wealth over time. Unlike a grocery bill or rent payment, these costs don’t show up as clear line items. Instead, they hide in plain sight: recurring subscriptions you no longer use, inefficient loan structures, or the long-term impact of high-fee investment accounts. They are subtle, persistent, and, most dangerously, normalized.

Consider this: a family earning $80,000 a year might feel financially stretched, despite having no major luxuries. Upon closer inspection, they’re paying $25 monthly for three streaming services, $15 for a cloud storage plan they rarely access, and $30 for a gym membership they haven’t used in months. Individually, these seem negligible. But collectively, they amount to nearly $1,000 a year—money that could have gone toward debt reduction, retirement, or an emergency fund. This is the nature of hidden costs: small in isolation, devastating in aggregation. And it’s not just about subscriptions. Behavioral patterns—like impulse buying during sales, paying late fees due to disorganization, or using high-interest credit cards for convenience—also contribute to this silent erosion.

Even more insidious is the concept of opportunity cost, which refers to what you give up by choosing one financial path over another. For example, keeping cash in a low-yield savings account may feel safe, but over ten years, the lost growth compared to a modest-yield investment can total thousands of dollars. That difference isn’t charged to you directly, but it’s just as real. These hidden costs don’t announce themselves. They don’t send bills. Yet they shape financial outcomes more than most people realize. The first step toward real financial freedom is awareness—recognizing that control starts not with income, but with visibility.

Mapping Your Money: A Real-World Cost Audit

Once you accept that hidden costs are shaping your financial reality, the next step is to bring them into the light. The most effective way to do this is through a comprehensive cost audit—a structured review of where your money goes, why it goes there, and whether it’s delivering value. This isn’t just about tracking expenses; it’s about analyzing them with intention. Many people use budgeting apps to monitor spending, but tracking alone isn’t enough. Without analysis, you’re just recording data, not gaining insight. A true audit requires categorizing expenses not just by type—housing, food, transportation—but by value and necessity. Is that monthly software subscription essential? Does that premium grocery delivery justify its cost compared to self-pickup?

Begin by gathering 90 days of transaction history from bank and credit card statements. Group expenses into broad categories, then drill down into subcategories. Look for patterns: Are there recurring charges on the same date each month? Are certain types of spending clustered around emotional triggers, like stress or boredom? One woman discovered she consistently spent $75 on online retail purchases every Sunday evening—a habit tied to weekend loneliness. Another found that his “convenience” food delivery services added over $4,000 annually, despite cooking at home being both cheaper and healthier. These aren’t failures of discipline; they’re symptoms of unexamined systems.

Housing and transportation often contain the largest hidden inefficiencies. A mortgage or rent payment may seem fixed, but small adjustments—like refinancing at a lower rate or downsizing to a more affordable home—can yield massive long-term savings. Similarly, car ownership involves more than just the monthly payment. Insurance, maintenance, fuel, registration, and depreciation all contribute to the total cost of ownership. One study found that the average cost of owning a new vehicle exceeds $10,000 per year. Yet many people don’t factor in these elements when making purchasing decisions. The same applies to financial products: bank fees, ATM charges, and overdraft penalties can add up quickly, especially for those living paycheck to paycheck.

The goal of a cost audit is not to eliminate all spending, but to align it with your values and goals. Some expenses—like quality childcare or reliable healthcare—are worth their cost. Others, like unused memberships or high-fee accounts, are simply leaks. By mapping your money with honesty and precision, you turn abstract concern into concrete action. You begin to see not just where your money goes, but how it could work harder for you.

The Efficiency Mindset: Rethinking Value Over Price

Many people equate saving money with spending as little as possible. But true financial wisdom lies not in minimizing price, but in maximizing value. This shift in thinking—the efficiency mindset—recognizes that sometimes, spending more upfront leads to greater savings over time. It’s the difference between being cheap and being smart. Consider home appliances: a $500 energy-efficient refrigerator may cost more than a $300 model, but it could save $50 a year in electricity over a 15-year lifespan. That’s $750 in savings—more than covering the initial price difference. The same principle applies to insulation, windows, or even tires: investing in quality reduces long-term costs.

This mindset extends beyond physical goods. Take insurance, for example. It’s tempting to choose the cheapest policy, but inadequate coverage can lead to catastrophic out-of-pocket costs when disaster strikes. A slightly higher premium that includes broader protection may save tens of thousands in the event of a medical emergency or property damage. Similarly, paying for professional financial advice—even if it comes with a fee—can prevent costly mistakes in investing, tax planning, or retirement strategy. The key is to evaluate total cost of ownership, not just the sticker price.

Another example is transportation. While a new car may seem expensive, a poorly maintained used vehicle can become a money pit due to frequent repairs, poor fuel efficiency, and higher insurance rates. In some cases, leasing a reliable, fuel-efficient model with a warranty may be more cost-effective than struggling with an aging car. The same logic applies to housing: a slightly higher rent in a walkable neighborhood might eliminate the need for a second car, saving thousands annually in transportation costs.

Adopting the efficiency mindset requires patience and foresight. It means resisting the impulse to choose the lowest price and instead asking: What will this cost me over time? How much value will I get? Will this decision support my long-term goals? When you prioritize value, you stop reacting to price tags and start making strategic choices. You begin to see spending not as a loss, but as an investment in stability, comfort, and freedom. And that changes everything.

Debt Decoded: When Interest Isn’t the Real Cost

When most people think about debt, they focus on interest rates. A 5% mortgage seems better than a 7% one. A 0% introductory credit card offer looks like a win. But interest is only part of the story. The real cost of debt often lies in its structure—the way it limits your choices, creates psychological pressure, and reduces financial flexibility. A loan with a low rate can still be costly if it locks you into long-term payments, restricts your ability to respond to emergencies, or prevents you from pursuing opportunities. True financial health isn’t just about minimizing interest; it’s about maximizing control.

Consider the case of car loans. A five-year auto loan with a 3% interest rate may seem affordable, but it means five years of fixed payments, regardless of changes in income or unexpected expenses. If you lose your job or face a medical issue, those payments don’t disappear. In contrast, paying cash—or using a shorter-term loan—may be more demanding upfront but offers greater peace of mind and flexibility. The same applies to personal loans used for home improvements or education. Even at low rates, multiple debt obligations can create a web of obligations that makes it difficult to adapt when life changes.

Another hidden cost of debt is opportunity cost. Money used to service debt cannot be used for investing, building emergency savings, or taking advantage of time-sensitive opportunities. For example, someone paying $300 a month toward a car loan over five years will spend $18,000—money that, if invested at a 6% annual return, could have grown to over $20,000. That’s not just the loss of principal; it’s the loss of potential growth. The burden isn’t just financial; it’s psychological. Studies show that people with high levels of debt report higher stress, reduced sleep quality, and lower life satisfaction—even when they can afford the payments.

The solution isn’t to avoid all debt, but to use it strategically. Productive debt—like a mortgage on a home that appreciates or a student loan that leads to higher earning potential—can be a tool for building wealth. Restrictive debt—like high-balance credit cards or long-term loans for depreciating assets—tends to hinder progress. The key is to evaluate debt not just by its rate, but by its impact on your freedom. Can you pay it off quickly? Does it align with long-term goals? Does it leave room for flexibility? When you shift from viewing debt as a transaction to seeing it as a constraint, you make better decisions.

Investment Leaks: How Fees Steal Your Returns

Many people believe that investment success is determined by stock picks or market timing. But in reality, one of the biggest factors shaping long-term returns is something far less exciting: fees. Investment fees—whether from mutual funds, advisors, or trading platforms—don’t attract attention, but they quietly erode returns over time. A 1% annual fee may seem small, but over 30 years, it can reduce your portfolio’s value by nearly a third. Unlike market downturns, which are temporary, fees are permanent. You pay them regardless of performance. And because they compound, their impact grows exponentially the longer you invest.

Consider two investors, each contributing $5,000 annually for 30 years with an average 7% return. One uses a low-cost index fund with a 0.05% expense ratio. The other uses an actively managed fund with a 1% fee. At the end of 30 years, the first investor has over $470,000. The second has just over $390,000—a difference of $80,000, all lost to fees. That’s not due to poor performance; it’s due to cost structure. The higher-fee investor earned the same market return but kept less of it. This is the hidden drag of investment fees: they don’t prevent growth, but they limit how much you benefit from it.

Fees come in many forms. Expense ratios are the most visible, but others are harder to spot. Advisor fees, whether flat or percentage-based, add up over time. Transaction fees from frequent trading eat into returns. Some retirement accounts charge administrative fees that few people notice. Even robo-advisors, often marketed as low-cost, may have hidden charges or higher spreads. The problem is compounded when fees are layered: a mutual fund with a 1% expense ratio inside a brokerage account with a 0.5% advisory fee results in a 1.5% total drag—more than many investors realize they’re paying.

The solution is not to avoid professional help, but to understand what you’re paying for. Low-cost index funds have consistently outperformed the majority of actively managed funds over time, largely because of their lower fees. By minimizing extraction, you maximize net returns. This doesn’t mean cutting corners—it means being intentional. Ask for full fee disclosures. Compare options. Consider whether the services justify the cost. For many, a simple, low-fee portfolio aligned with long-term goals delivers better results than complex, high-cost alternatives. When it comes to investing, the best strategy isn’t always the flashiest—it’s the one that keeps more of your money working for you.

Building Systems, Not Just Savings

Willpower is unreliable. Motivation fades. But systems endure. This is the core insight behind lasting financial control: sustainable freedom comes not from discipline, but from design. Instead of relying on daily choices to save or avoid spending, build systems that automate good behavior and prevent backsliding. A well-structured financial system includes buffers, rules, and feedback loops that protect against hidden costs and human error. It turns intention into routine, making financial health a default state rather than a constant struggle.

Start with automation. Set up direct deposits that split your paycheck between checking, savings, and investment accounts before you even see the money. This ensures consistent saving without decision fatigue. Use bill pay systems to avoid late fees. Create spending rules—like a 24-hour waiting period for purchases over $100—to reduce impulse spending. These small structures reduce the need for constant vigilance. One woman set up a rule that any subscription over $10 required annual review and manual renewal. This simple step eliminated six unused services within a year, saving over $600.

Equally important are feedback mechanisms. Schedule quarterly financial reviews to audit spending, update budgets, and reassess goals. Use alerts for unusual transactions or low balances. Share financial check-ins with a trusted partner to increase accountability. These practices create a cycle of awareness and adjustment, preventing small leaks from becoming major problems. They also help you adapt to life changes—marriage, children, career shifts—without losing financial ground.

Another key component is the emergency fund. Without one, unexpected expenses—car repairs, medical bills, job loss—force you into debt or derail savings. A buffer of three to six months’ expenses acts as a shock absorber, allowing you to handle surprises without financial trauma. This isn’t just about saving money; it’s about building resilience. When you have a safety net, you’re less likely to make reactive, high-cost decisions under pressure.

Systems also include behavioral design. Keep high-yield savings accounts separate from checking to reduce temptation. Unsubscribe from marketing emails to reduce exposure to sales. Use cash or debit for discretionary spending to stay within limits. These aren’t restrictions—they’re enablers. They free you from constant decision-making, so you can focus on life, not money. When systems do the work, financial control becomes effortless.

The Freedom Equation: Costs, Choices, and Control

Financial freedom is not a number in a bank account. It’s the ability to make choices without fear. It’s having the flexibility to change jobs, care for a loved one, pursue a passion, or handle a crisis without financial paralysis. And the foundation of that freedom is not just income or savings—it’s cost control. Every dollar you stop losing is a dollar that gains you more options. Every hidden cost you eliminate increases your autonomy. This is the freedom equation: minimized drag plus maximized flexibility equals real control.

Most financial advice focuses on earning more or cutting obvious expenses. But the real breakthrough comes from mastering the unseen. It’s about shifting from reactive management to proactive design. It’s recognizing that financial health is not a destination, but a practice—one that requires ongoing attention, adaptation, and clarity. The habits that matter most aren’t about deprivation, but about awareness. They’re about asking not just how much something costs, but what it costs you over time. They’re about building systems that protect you when motivation wanes.

And perhaps most importantly, this journey is not about perfection. It’s about progress. You don’t need to eliminate every fee or achieve zero debt overnight. You need to start seeing, start adjusting, start building. Every audit, every system, every conscious choice moves you closer to a life where money serves you, not the other way around. When you master hidden costs, you don’t just save money—you gain time, peace of mind, and the power to shape your own future. That’s not just financial freedom. That’s real freedom.