How I Smartened Up My Spending on Luxuries—And Made My Money Work Harder

You love quality experiences—fine dining, designer pieces, premium travel. But what if your high-end lifestyle could also build wealth instead of draining it? I used to think luxury and smart finance didn’t mix—until I discovered the right tools. This isn’t about cutting back; it’s about upgrading your financial strategy. Let me show you how I turned indulgent spending into a smarter wealth-building system without sacrificing the lifestyle I earned. The journey began not with deprivation, but with awareness: every dollar spent on luxury could either vanish or be redirected to work harder. With the right approach, even the most enjoyable expenses can contribute to long-term financial strength. This is not about frugality—it’s about intentionality.

The Hidden Cost of Living Luxuriously

Luxury spending often feels justified. After years of hard work, treating yourself to a designer handbag, a weekend at a five-star resort, or dinner at a Michelin-starred restaurant can seem like a well-earned reward. Yet behind these pleasures lies a quiet but persistent financial drain—one that many overlook until it’s too late. The true cost of luxury isn’t just the price tag; it’s the opportunity cost, the money that could have grown if invested instead. A $3,000 handbag today could be worth over $10,000 in 20 years if invested at a conservative 6% annual return. That’s not to say such purchases are inherently wrong, but rather that they should be made with full awareness of what’s being given up.

The psychological pull of luxury is strong. Marketing, social cues, and personal milestones all encourage us to equate spending with success. This phenomenon, known as lifestyle inflation, occurs when income rises but so does spending—often on visible, high-status items. The danger isn’t in occasional indulgence, but in the gradual normalization of expensive habits. What begins as a rare treat becomes routine, and savings rates stagnate or decline. Over time, this pattern erodes financial flexibility, making it harder to weather emergencies or plan for long-term goals like retirement or children’s education.

Another hidden cost is emotional decision-making. Luxury purchases are often impulse-driven, fueled by limited-time offers, exclusive access, or social pressure. These moments bypass rational evaluation, leading to regret later. Without a clear framework for assessing value, it’s easy to confuse desire with necessity. The solution isn’t to eliminate luxury, but to redefine it—shifting from consumption for status to consumption for meaning. When spending aligns with personal values, such as family, health, or lifelong learning, it becomes more fulfilling and less wasteful. This mindset shift is the first step toward building wealth while still enjoying life’s finer things.

Rethinking Wealth: When Spending Can Actually Grow Your Money

Not all spending diminishes wealth—some of it builds it. The key lies in distinguishing between consumptive spending and productive spending. Consumptive spending provides immediate pleasure but leaves no lasting value, like a meal eaten or a fashion item worn once. Productive spending, on the other hand, generates returns over time, whether financial, professional, or personal. When applied to luxury, this concept transforms how we view high-end purchases. Certain indulgences, when chosen wisely, can appreciate in value, open doors to opportunity, or enhance earning potential.

Consider high-quality education or skill development. Enrolling in an executive leadership program or a specialized certification may carry a premium price, but the long-term payoff can be substantial. Increased confidence, expanded networks, and career advancement often follow. Similarly, investing in tools that improve productivity—such as a high-performance laptop or professional coaching—can yield measurable returns. These are not expenses; they are investments in human capital, a form of wealth that compounds over time.

Another example is strategic networking. Membership in exclusive professional associations or attendance at elite industry conferences may seem like luxury events, but they often lead to partnerships, job offers, or business ventures. The cost of a $5,000 conference pass pales in comparison to a $50,000 contract secured through a single conversation. In this context, luxury becomes a gateway to opportunity. The same principle applies to health: premium wellness programs, preventative care, or fitness coaching can reduce future medical costs and improve quality of life, effectively increasing one’s earning years.

Even tangible luxury assets can be productive. A classic timepiece or fine art piece may hold or increase in value over decades, especially if well-maintained and authenticated. Unlike fast fashion or disposable electronics, these items can be resold, passed down, or used as collateral. The shift in mindset is crucial: instead of asking “Can I afford this?” ask “Will this add value over time?” By focusing on durability, utility, and potential return, luxury spending becomes part of a broader wealth strategy rather than a detour from it.

The Right Tools: How Premium Financial Products Elevate Your Game

Managing luxury spending effectively requires more than discipline—it demands the right financial infrastructure. Standard checking and savings accounts, while safe, often yield minimal returns and offer little in the way of rewards or integration with high-end lifestyles. To make luxury spending work for you, advanced but accessible financial tools are essential. These include high-yield cash management accounts, premium credit cards with robust rewards programs, and personalized digital investment platforms. When used wisely, these tools can turn everyday indulgences into sources of passive income and long-term growth.

High-yield cash management accounts are a cornerstone of modern wealth-building. Offered by many online banks and financial institutions, these accounts typically provide interest rates significantly higher than traditional savings accounts—sometimes over ten times higher. They often come with no monthly fees, easy access, and FDIC insurance, making them both safe and efficient. For someone who frequently dines out or travels, keeping funds in such an account ensures money is earning while waiting to be spent. This small shift can generate hundreds or even thousands in extra income annually, simply by optimizing where cash sits.

Premium credit cards are another powerful tool. Cards designed for affluent consumers often offer high cashback rates, travel perks, concierge services, and sign-up bonuses worth hundreds of dollars. A card that returns 3% to 5% on dining, travel, and luxury retail spending can effectively reduce the net cost of these purchases. The key is disciplined use: paying off the balance in full each month to avoid interest charges. When managed properly, these cards function as a rebate system, not a debt trap. Over time, accumulated points can cover flights, hotel stays, or even entire vacations—turning discretionary spending into free experiences.

Robo-advisors with premium tiers offer personalized investment management with low overhead. These platforms use algorithms to build diversified portfolios based on risk tolerance and goals, often including access to tax-loss harvesting, automatic rebalancing, and retirement planning tools. Some even integrate with credit card spending data to provide real-time insights. For the luxury spender, this means investments grow in the background while life continues uninterrupted. The convenience and customization of these services make sophisticated wealth management accessible without requiring a private banker or large minimum balances.

Turning Luxury Purchases into Passive Income Streams

What if your luxury items didn’t just depreciate—but paid you back? A growing number of platforms and financial models now allow consumers to monetize high-end assets, transforming personal indulgences into income-generating tools. This shift—from ownership as consumption to ownership as investment—is redefining how affluent individuals approach spending. By leveraging technology and shared economy principles, it’s possible to earn returns on items that were once purely for personal enjoyment.

Designer fashion, for instance, can be leased or rented through specialized platforms. High-end handbags, watches, and clothing retain value better than mass-market items, and their exclusivity drives demand. Instead of letting a $4,000 handbag sit unused in a closet, owners can list it for weekly or monthly rental, earning a portion of its value over time. Some services handle authentication, insurance, and shipping, reducing the hassle. While not every item is suitable, timeless pieces from established brands often yield strong returns, especially during peak seasons like holidays or fashion weeks.

Vacation properties offer another powerful opportunity. Rather than financing a second home that sits empty most of the year, co-ownership or fractional ownership models allow multiple buyers to share costs and usage. Platforms facilitate scheduling, maintenance, and even rental management when owners aren’t using their time. A $750,000 beachfront condo might require a $150,000 share, but when rented out during high-demand periods, it can generate thousands per month. After expenses, this income can cover ownership costs and even produce surplus cash flow. Over time, the property may also appreciate, creating long-term equity.

Collectible luxury goods—such as rare wines, vintage watches, or fine art—can also be invested in directly. While these markets require knowledge and caution, they have historically outperformed traditional assets during certain periods. Some platforms now offer fractional investing in collectibles, allowing individuals to own a piece of a $500,000 watch without the full upfront cost. Storage, insurance, and authentication are handled professionally, reducing barriers to entry. For those already drawn to luxury items, this approach aligns passion with profit, turning personal taste into a diversified investment strategy.

Risk Control: Avoiding the Pitfalls of High-End Financial Tools

With greater rewards come greater risks—and premium financial tools are no exception. The allure of high cashback rates, exclusive access, or investment opportunities can tempt even cautious individuals into overextending. The most common danger is overspending to chase rewards. Some consumers increase dining out or shopping simply to meet credit card spending thresholds for bonus points, ultimately spending more than they save. This behavior turns a financial tool into a liability, undermining the very goal of wealth-building.

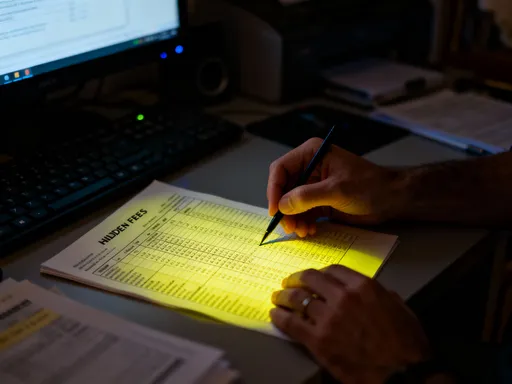

Another risk is complexity. Premium financial products often come with intricate terms, fees, and conditions. Annual fees on luxury credit cards can exceed $500, and foreign transaction fees may apply even on travel cards. Investment platforms may charge performance fees or hidden administrative costs. Without careful review, these expenses erode returns over time. Additionally, some “exclusive” offers are marketed as limited-time opportunities, creating pressure to act quickly without proper due diligence. This can lead to poor decisions, such as investing in unregulated collectibles or signing up for unnecessary services.

Debt accumulation is perhaps the most serious risk. While premium credit cards offer valuable rewards, they also come with high credit limits. Without strict budgeting and monthly repayment, balances can grow quickly, and interest charges can outweigh any benefits. Minimum payment traps and revolving debt can spiral, especially when multiple cards are involved. The psychological effect of “invisible” spending—swiping a card without feeling the immediate loss of cash—further exacerbates the problem. The solution lies in discipline: treating credit as a convenience, not a source of funds.

To mitigate these risks, clear guardrails are essential. Set monthly spending limits aligned with your budget, regardless of rewards potential. Automate payments to ensure balances are paid in full. Regularly review statements and cancel underused cards or subscriptions. Educate yourself on terms and fees before committing. Most importantly, maintain a long-term perspective—financial health is measured not by points earned, but by net worth grown. By using tools intentionally, not impulsively, you preserve both your lifestyle and your future.

Practical Strategies for Seamless Integration

Turning theory into practice requires a system that fits naturally into daily life. The goal is not to micromanage every dollar, but to create habits and structures that automatically align luxury spending with wealth-building. This begins with a clear framework: the “value-first” spending rule. Before any purchase, ask: Does this enhance my life in a meaningful way? Will it last, appreciate, or provide lasting benefit? If the answer is no, reconsider. This simple filter reduces impulsive buys and prioritizes items that truly matter.

Next, automate reward capture. Link premium credit cards to recurring luxury expenses—such as club memberships, streaming services, or travel bookings—and set up automatic payments. Use apps that track points, notify expiration dates, and suggest optimal redemption strategies. Some platforms even sync with calendars to recommend flight upgrades or hotel stays based on accumulated rewards. This hands-off approach ensures you benefit without constant monitoring.

Tiered financial accounts can further streamline the process. Maintain separate accounts for different purposes: one for daily spending, one for high-yield savings, and one for investments. Allocate a percentage of income—say, 20%—to the savings and investment accounts before spending begins. This “pay yourself first” method ensures growth continues regardless of lifestyle costs. When a luxury purchase is made, transfer a small portion—perhaps 5% of the cost—into an investment account as a self-imposed “luxury tax.” Over time, this habit compounds, turning indulgence into indirect savings.

Consider a real-world example: planning a luxury vacation. Book flights and hotels using a premium travel card to earn points. Pay for experiences like spa treatments or fine dining with a cashback card. After the trip, review statements and redeem points for future travel or statement credits. Transfer a portion of the total cost into a brokerage account. The experience remains enriching, but the financial impact is neutral or even positive. This method transforms what was once a pure expense into a balanced exchange of value.

Building a Lifestyle That Earns While You Enjoy

True financial freedom isn’t found in denial, but in design. It’s possible to live richly—not just in experience, but in net worth—by aligning spending with strategy. The women who master this balance don’t deprive themselves; they upgrade their approach. They understand that luxury, when chosen with intention and supported by smart tools, doesn’t threaten wealth—it fuels it. The handbag, the getaway, the gourmet meal—none must be sacrificed. Instead, they become part of a larger system where every dollar has a purpose.

This mindset shift brings quiet confidence. There’s no guilt in spending because it’s no longer reckless—it’s deliberate. There’s no anxiety about the future because growth is happening in the background. Investments compound, rewards accumulate, and assets generate returns, all while life is fully lived. The result is a self-reinforcing cycle: enjoyment funds growth, and growth enables more enjoyment. Over time, this creates resilience, flexibility, and freedom—the true markers of wealth.

The journey begins with a single question: How can this purchase work for me? From there, small changes build momentum. Choose the right card. Track the rewards. Reinvest a portion. Stay disciplined. These actions, repeated consistently, transform habits. And as the years pass, the difference becomes undeniable—not in what is given up, but in what is gained. A life of beauty, comfort, and joy, supported by a foundation of strength. That is the power of spending smarter, not less. That is how luxury becomes legacy.